Centuria upgrades earnings guidance ahead of interim results

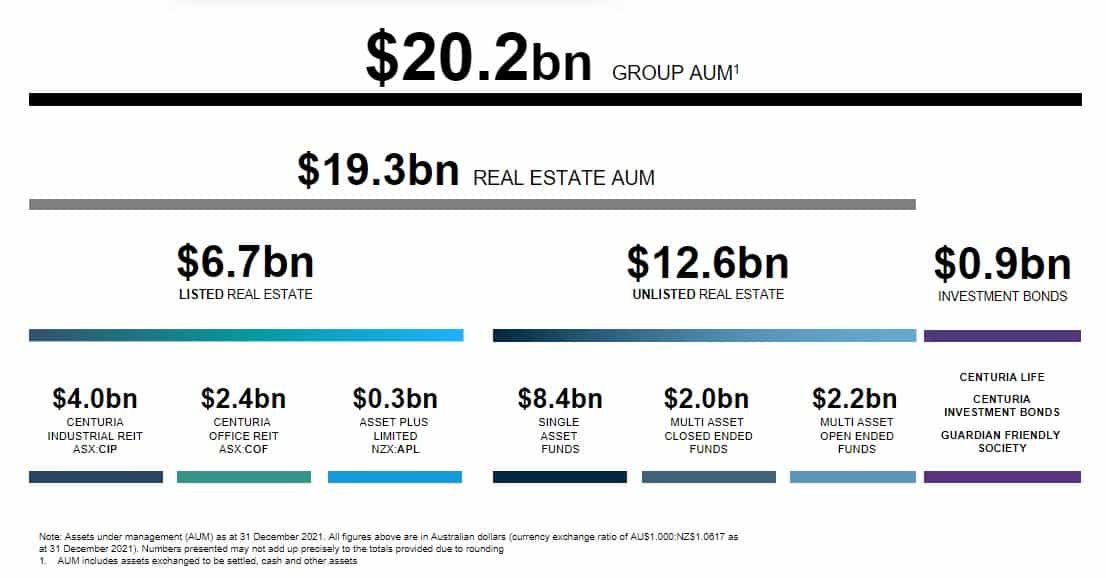

- Upgrades FY22 OEPS guidance to 14.5cps1 (+9.85%); Expands Group AUM to $20.2bn2 (+16%)

- Reaffirms FY22 distribution guidance of 11.0cps

- HY22 Results to be announced on 9 February 2022

ASX-200 listed, Centuria Capital Group (ASX: CNI or “Centuria”), has upgraded its operating earnings per security (OEPS)3 guidance of 14.5 cents per security (cps) for the 2022 Financial Year ahead of its interim results, which are due to be released on Wednesday 9 February.

Additionally, the Australasian real estate funds manager confirmed its Group assets under management (AUM) expanded to $20.2 billion2 during the first six months of FY22, a 16% expansion.

Its platform growth has been credited to high-quality real estate acquisitions, a strong increase in both pipeline and completed developments, healthy revaluations, and compelling performance fees, which underpin the OEPS upgrade.

Centuria’s upgraded OEPS guidance is 9.85% above its initial FY22 guidance of 13.2cps and a 20.8% increase above FY21 OEPS of 12.0cps.

Centuria previously declared an HY22 distribution of 5.5cps and re-affirms FY22 distribution guidance of 11.0cps.

John McBain, Centuria Joint CEO, said “During HY22 CNI has continued to execute on its strategy. Our ability to source quality real estate investments in a repeated fashion, together with deliberate corporate acquisitions, has accelerated our growth and continues to create value for securityholders. These outcomes delivered strong performance across our Australasian funds management platform leading to today’s upgraded FY22 earnings guidance.”

Jason Huljich, Centuria Joint CEO, said “Our real estate platform has recorded exceptional organic growth in HY22, aided by contributions across Australia and New Zealand, our listed and unlisted real estate divisions and all seven major asset classes. The upgraded earnings guidance has been driven to a large extent by continuing strong investment property markets producing significant valuation growth and leading to higher management and performance fee expectations for FY22.”

Centuria specialises in real estate markets including decentralised offices, urban infill industrial assets, cost-efficient healthcare property, daily needs retail (DNR), large format retail (LFR) and agriculture across Australia and New Zealand. It also provides non-bank financing for the Australian property market through Centuria Bass Credit.

Centuria has strengthened its market offering by diversifying into new asset classes. In 2017, it diversified into industrial assets, in 2019 into healthcare real estate, and in 2021 into DNR, LFR, agriculture and unlisted real estate debt funds.

Its suite of investment products include listed and unlisted real estate funds across debt and equity markets. Additionally, it provides investment bond options with its “LifeGoals” product range.

Centuria’s platform has delivered a 45% Compound Annual Growth Rate (CAGR)4 since 2017, with AUM growing from $3.8 billion to $20.2 billion between 30 June 2017 to 31 December 2021.

A leading Australasian real estate funds manager

Included in the S&P/ASX200 Index

1. Previous FY22 operating EPS guidance of 13.2cps as provided on 11 August 2021. Guidance remains subject to unforeseen circumstances and material changes in operating conditions.

2. AUM as at 31 December 2021. Includes assets exchanged but not settled, cash and other assets.

3. Operating EPS is calculated based on the Operating NPAT of the Group divided by the weighted average number of securities.

4. Past performance is not a reliable indicator of future performance.

Related articles

ANZAC Day 2022

Centuria pays tribute to our ANZACs who gave their lives for our freedom. This ANZAC Day, we commemorate the service and sacrifice of those Australian and New Zealand Army Corps. Lest we forget.International Women’s Day 2022

This International Women’s Day we celebrate the many achievements of women around the world and the journey towards gender equality. The 2021 official theme is #ChooseToChallenge – encouraging all to challenge the status quo, as challenge leads to change.