News and media

Find all the news from the Centuria Industrial REIT (ASX:CIP).

How Australia’s 2020 infra peak will fuel industrial property

The infrastructure investment boom, combined with e-commerce, manufacturing trends, and other developments, signals both change and good news for industrial real estate. Read our eBook – How Australia’s 2020 infra peak will fuel industrial property – to find out more. Ross Lees interview with Peter Switzer about the report

Centuria Industrial REIT FY19 Results

Centuria Industrial REIT (ASX:CIP), Australia’s largest ASX listed domestic pure play industrial REIT, today announced FY19 results to 30 June 2019.

Successful completion of $70m institutional placement for CIP

Centuria Industrial REIT (CIP), is pleased to announce the successful completion of the fully underwritten institutional placement announced on 27 June 2019, raising $70 million through the issue of approximately 23 million new CIP units at an issue price of $3.05 per new unit. Proceeds of the placement will be used for the acquisition of three high quality industrial assets for a combined value of $59.3 million (excluding costs) with a further $10 million earmarked for capital expenditure to enhance the assets.

Centuria Capital Announces Senior Management Appointments

Jason Huljich appointed joint CEO, alongside John McBain who remains in a full-time capacity as joint CEO Ross Lees appointed Head of Funds Management Centuria Capital Group (Centuria ASX: CNI) has announced two internal promotions effective 21 June 2019. Jason Huljich, previously Head of Real Estate and Funds Management, will join John McBain to co-lead the Group.

5 steps to commercial property success

There are no guarantees in life or in property investment but there are 5 key things to consider when deciding who to trust with your money. If you’re thinking about investing in a property trust, you should analyse the following characteristics to help choose a property investment manager that you can rely on to make consistently good decisions.

Changing retail landscape affects industrial sector

Ross Lees, Fund Manager for Centuria Industrial REIT, shares his opinion on the link between industrial property and the changing make-up of the retail sector. The retail sector continues to perform well despite recent gloomy headlines. Data shows to December 2018, retail sales (online and in-store) grew 3.1% year-on-year1. Australia has a growing population (up 1.6% year-on-year)2 and 26 years of uninterrupted economic growth3.

Centuria Industrial REIT 1H19 results

Strengthening industrial markets drive strong half-year results, says CIP Centuria Property Funds No. 2 Limited (CPFL2), as Responsible Entity of Centuria Industrial REIT (ASX: CIP), is pleased to announce CIP’s half year financial results for the period ended 31 December 2018. 1H19 financial highlights include: 1H19 Statutory profit of $46.1 million Distributable earnings of $23.3 million 12-month Return on Equity1 (ROE) of 15.8% Balance sheet gearing2 reduced to 37.0%3.

Change in Registry Service Provider

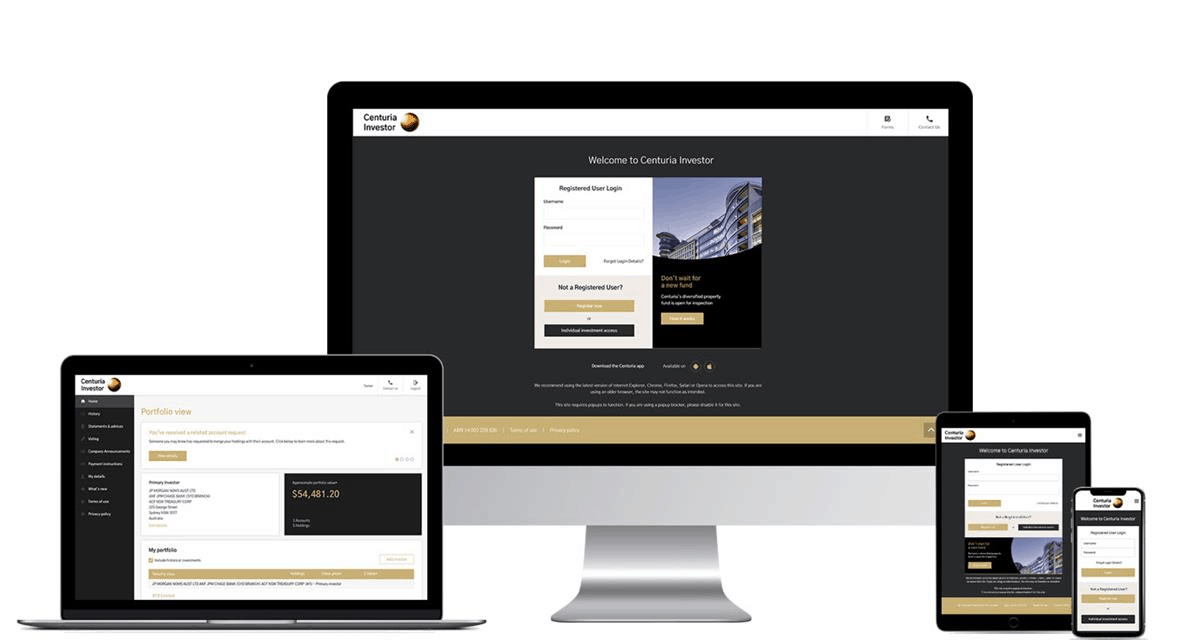

Centuria is transitioning its registry service provider to Boardroom Pty Limited (BoardRoom) for all investments.

What’s next in industrial property investment: should you be looking at multi-storey warehousing in Australia?

By Ross Lees, Fund Manager Centuria Industrial REIT On the face of it, multi-storey warehouses seem to be the perfect solution to the challenges of an industrial sector both constrained by a shortage of land and driven to improve efficiency by a competitive market. And in Asia, this is exactly the response we are seeing: sixty percent of industrial warehouses in Singapore are multi-level,

Property market update with Jason Huljich – December 2018

Centuria’s Head of Real Estate and Funds Management, Jason Huljich, shares his view on current key property themes and the outlook for commercial and industrial property. What is your role at Centuria Capital? My role at Centuria Capital is Head of Real Estate and Funds Management. So I mainly oversee the $4.6 billion dollars of assets we have in both our listed and our unlisted property funds,

Centuria wraps up successful year with strategic acquisitions

Centuria Capital Group has grown from $4.6 billion AUM to $5.5 billion1 since 31 December 2017 Centuria Capital Group (Centuria) today announced that Centuria Industrial REIT (CIP) has added two industrial properties to its portfolio. The properties were purchased for a combined total of $54.4 million (excluding costs), with $51 million of the purchase price raised via an underwritten entitlement offer.

3 golden rules for tough property markets

Investors considering property funds want to be assured of both strong ongoing income returns and promising long-term total returns – and there are various factors that determine these: how good a fund manager is at buying, selling, and improving properties, of course. But we believe that leasing, while far from the only consideration in property investment,