Office property 2018 outlook: showing strong fundamentals

Sydney and Melbourne have been the pick for office property returns over the past few years. Despite some significant yield compression in both markets, they continue to present strong fundamentals and good opportunities for investors this year. At the same time, the second half of last year evidenced some promising green shoots to our north in Brisbane, and even to our west in mining-dependant Perth, setting the tone for what’s to come. Jason Huljich, CEO of Unlisted Property Funds for Centuria, looks at where the returns came in for his investors in 2017 and where he’ll be seeking them this year.

Overall, 2017 presented no real surprises for commercial property investors, and we are likely see more of the same in early 2018. With the national office vacancy rate falling in 2017 by 1.5% to 10.4%[1] and rents increasing, the value of commercial property has lifted across the board with strong demand from both local and global investors. This is strongest in Sydney and Melbourne, where this demand – particularly from overseas buyers – has seen significant yield compression.

Yield compression in Sydney sign of rising prices

The sale of Sydney’s Australian Securities Exchange building to a Hong Kong investor for $330 million last year, for example, was struck at cap rate of 4.6% – setting a new return benchmark for investors and serving as a reminder of the recent uplift in values. In a number of other sub 5% yield deals, boutique B-grade office 28 O’Connell Street was bought by Coombes Property for $91 million, and 210 and 220 George Street were sold to Chinese state-owned Poly Group for $165 million; almost 60% more than what they were purchased for at around the same time the year prior.

In what has been described as the “Deal of the year”, Centuria also settled contracts with Lendlease to sell 10 Spring Street, Sydney for $270.05 million in October last year, reflecting a 3.9% passing yield and a capital value rate of $19,447 psm. The listing resulted in significant interest from both local and global investors who were looking for 100% ownership of a property with development potential in the heart of the CBD, and ultimately led to the record sale price. This exceptional result tripled the original purchase price of $91.6 million in 2013 and is just one example of the significant investor appetite for Sydney CBD assets that we expect to continue steadily into the new year.

Concerns of a bubble overstated

Despite the concerns expressed by the Reserve Bank about the sustainability of recent pricing levels, we believe the likelihood that commercial property is in a bubble on the verge of bursting is potentially overstated. The spread between government bond rates and property yields remains substantial enough to keep investors happy, and we anticipate that further strong rental growth in both Sydney and Melbourne will keep the lure of quality commercial property alive.

This is backed up by a global survey of investors undertaken by CBRE last year, which identified this yield spread (between property and the risk-free bond rate) as the dominant factor influencing foreign investors – ahead of capital appreciation, income levels and geographic diversification. This spread puts markets like Melbourne, Sydney, and to a lesser extent Brisbane, in a strong position going forward, as compared with a number of Asia-Pacific markets.

Sydney CBD vacancy rates driving demand in metro markets

Sydney is set to benefit from the $12.1 billion investment in public transport infrastructure currently underway. This is driving demand for office space, not just in the CBD, but also in metro markets, where new transport links are likely to improve commuting times and connectivity.

Furthermore, improving economic conditions have buoyed corporate Australia’s confidence in the medium-term revenue outlook, translating into strong employment growth throughout 2017. As a result, we have seen a corresponding decline in office vacancies across the nation – but especially in Sydney. As recently reported by commercial agents JLL, Sydney’s CBD office vacancy rate fell to 5.4% in the December quarter, down from 7.7% 12 months prior and prime rents have increased more than 20%.

As a result, quality stock remains scarce in the Sydney CBD market, prompting strong demand and upward pressure on prices. The withdrawal of office space for conversion to residential – and for the construction of the Metro Rail project – continues to play a role in reducing supply, although we believe that the majority of these withdrawals have now been completed.

To our north, Brisbane is picking up

There is good news in Brisbane, where the office market is showing signs of reinvigoration. Vacancy rates have stabilised, and with no significant supply coming online anytime soon, we expect to see some recovery in rents.

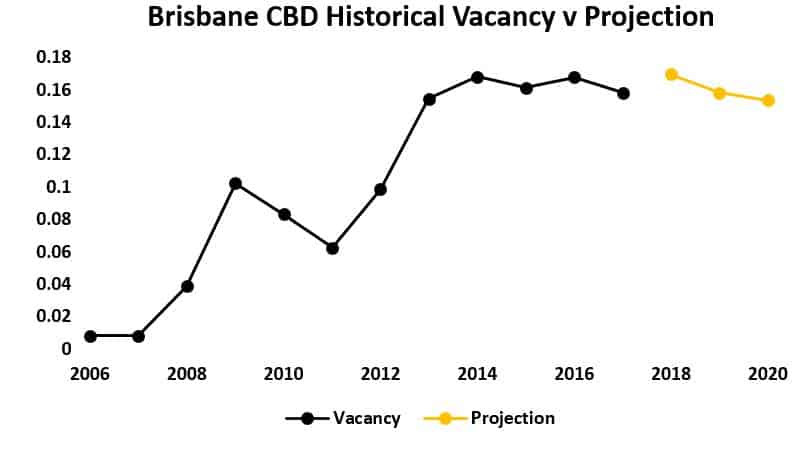

In fact, as shown in the graph below, our expectation is that vacancy rates have peaked and will begin to fall over the next few years. According to JLL, the Brisbane CBD office leasing market ended 2017 in a stronger position than it started, with the overall vacancy rate falling to 15% from 16.8% a year ago and a positive net absorbtion of 33,200 sqm recorded over the . This has been confirmed with several transactions in Brisabane CBD, the fringe and suburban markets in the first half of 2017, suggesting increased investor appetite and compressing yields.

To the south, a bright spot in Geelong

We see the regional city of Geelong, the second largest in Victoria, undergoing a significant reinvigoration – thanks in large part to the relocation of several Government agencies, including WorkSafe and the National Disability Insurance Agency. The city is currently an hour from Melbourne by train, but this should drop by 20 minutes with the completion of Transurban’s West Gate Tunnel Project. On track for 36.5% population growth over the next 18 years, the city offers an attractive prospect for investment.

To this end, Centuria has acquired an A-Grade building at 60 Brougham Street for $115.25 million. The office building has ten years remaining on a lease to the AAA-rated State Government owned entity, the Traffic Accident Commission. The Centuria Geelong Office fund, a single asset unlisted fund, will launch February 2018.

To our west, the first green shoots are appearing in Perth

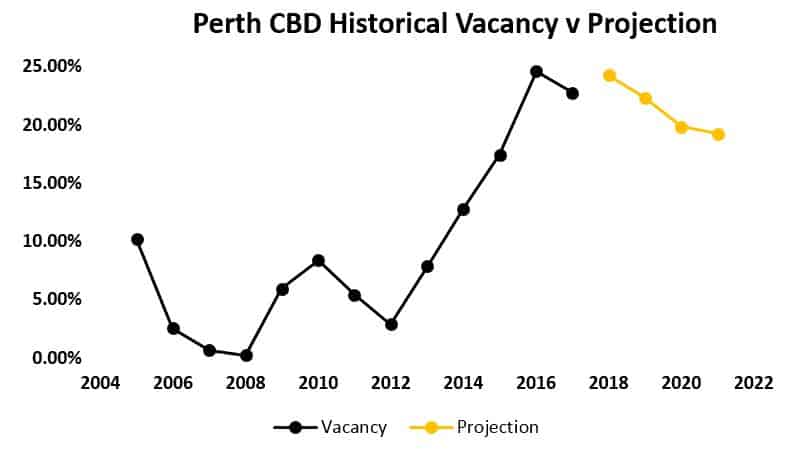

In what has been the weakest of the CBD markets in recent years, yields are now holding up in Perth, with some indications of improving fundamentals. According to JLL, Perth’s vacancy rate remained high at 21.8%, but fell from 24.1% a year ago with a net absorbtion of 41,800 sqm in 2017.

The general feeling about mining is more optimistic than it has been, and some of the larger corporations, like Chevron for example, which has been shedding large numbers of staff over the past few years, are now starting to employ again – all good news for office space.

As evidenced in the graph below, we believe that vacancy rates, while still very high, have peaked, and moving forward we expect to see them start to fall as the economy in Western Australian continues to pick up.

Canberra stable

Canberra remains stable and its fundamentals sound. Vacancies are low in A grade stock, and we believe that downward pressure will continue. Effective rents are beginning to rise and there is some buyer-side demand that is helping keep prices solid. We continue to focus on B and C grade space where there is potential for refurbishment and upgrades.

Conclusion

We continue to actively seek quality property in markets across the country. As asset-specific buyers, we consider all properties that we believe we can actively manage for the potential to produce an attractive return for investors – even in markets with weaker fundamentals. As we anticipated, with the sale of 10 Spring Street in Sydney’s CBD, we received outstanding results our investors that will allow us to re-direct that capital to other markets where we see value.

[1] Australian Financial Review, Sydney office vacancy rate lowest in almost a decade, rents up 20pc, 18 January 2018