News and media

Please find below news and media articles related to Centuria’s unlisted property funds.

Centuria continues to deliver for its established unlisted property division

Centuria Property Funds Limited (Centuria) has exchanged contracts to divest 2-10 Wentworth Street, Parramatta NSW for $105.3m following the completion of the closed ended property fund’s five year term. The property was acquired in December 2014 for $45.1 million. The successful sale reflects Centuria’s proactive asset management capabilities and the current strength across the commercial transaction markets.

Centuria’s unlisted retail property funds remain at the top of the index

For the tenth quarter in a row, Centuria’s Unlisted Property team has achieved six funds in the top 10 in Australia’s unlisted retail property fundsector’s leading index. Centuria has again taken the top honours in the recently released June 2019 quarter, with Centuria funds taking the top six places based on total return performance for the 12 months to 30 June 2019.

Centuria Diversified Property Fund acquires the top-tier ‘Optus Centre’ from Quintessential Equity

Centuria Diversified Property Fund (CDPF) has announced the acquisition of the Optus Centre, Canberra, for $35 million from commercial property group Quintessential Equity.

5 steps to commercial property success

There are no guarantees in life or in property investment but there are 5 key things to consider when deciding who to trust with your money. If you’re thinking about investing in a property trust, you should analyse the following characteristics to help choose a property investment manager that you can rely on to make consistently good decisions.

Centuria announce the formation of Centuria Heathley Limited

Centuria has entered the strongly performing healthcare real estate sector with its wholly-owned subsidiary, Centuria Platform Investments Pty Ltd, acquiring a 63.06% economic interest in Heathley Limited’s (Heathley) property funds management platform for $24.4 million.

Centuria’s unlisted retail property funds maintain the edge

For the ninth quarter in a row, Centuria’s Unlisted Property team has achieved six funds in the top 10 in the Australian unlisted retail property sector’s leading index. Once again Centuria has taken the top honours in the recently released March 2019 quarter, with Centuria funds taking five of the top six places based on total return performance for the 12 months to 31 March 2019.

Coming of age for Centuria Diversified Property Fund

Fund Manager, Doug Hoskins, discusses how the Centuria Diversified Property Fund’s planned purchase of its first direct asset represents a step change for the fund.

Centuria Diversified Property Fund meets income and liquidity needs

While the residential property market may be in the doldrums, the commercial property sector is continuing to perform well, providing an attractive option for investors seeking property exposure.

What should office property investors expect in the Year of the Pig?

The Australian economy performed well in 2018 – growth accelerated, unemployment fell and construction activity remained strong. It was a busy year for commercial property as well.

Centuria’s unlisted retail property funds still at the top of the index

For the eighth quarter in a row, Centuria’s Unlisted Property team has achieved six funds in the top 10 in the Australian unlisted retail property sector’s leading index.

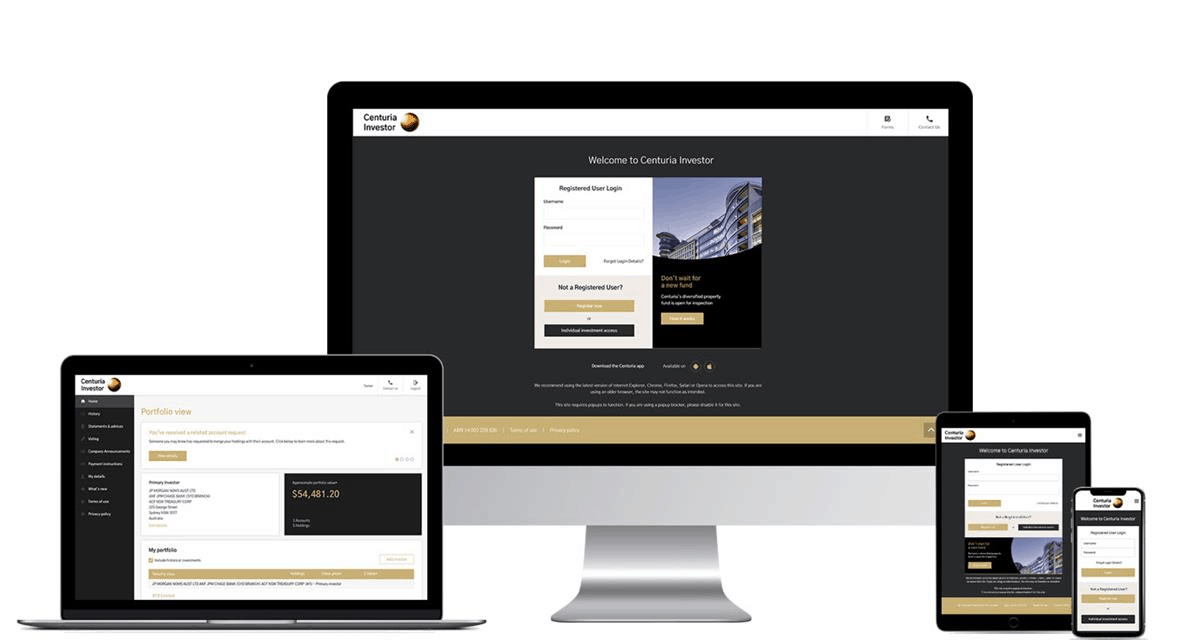

Change in Registry Service Provider

Centuria is transitioning its registry service provider to Boardroom Pty Limited (BoardRoom) for all investments.

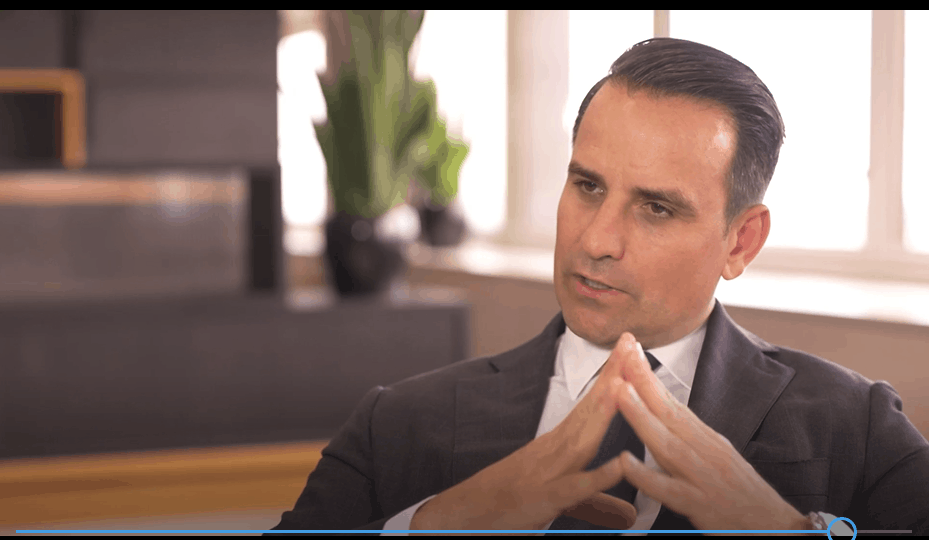

Property market update with Jason Huljich – December 2018

Centuria’s Head of Real Estate and Funds Management, Jason Huljich, shares his view on current key property themes and the outlook for commercial and industrial property. What is your role at Centuria Capital? My role at Centuria Capital is Head of Real Estate and Funds Management. So I mainly oversee the $4.6 billion dollars of assets we have in both our listed and our unlisted property funds,