You are now leaving Centuria Australia

and entering Centuria New Zealand.

Why invest in the healthcare property sector?

The healthcare sector is underpinned by growing non-discretionary demand for healthcare services. The key healthcare demand drivers in Australia* can be summarised as:

- Ageing population

- Increase in number of Australians aged 65 years and over is expected to continue to drive higher healthcare spend

- This age group suffers from a greater incidence of illness/disease and have a greater need for healthcare services.

- Longer life expectancy

- Scientific and technological advancements have resulted in patients living longer and being treated for longer, increasing the demand for healthcare

- Average life expectancy at birth is predicted to reach 88 and 90 years for males and females respectively by 2055.

- Chronic disease occurrence

- Improvements in detection and treatment, as well as lifestyle factors (e.g. poor diet and limited exercise) are increasing the incidence of chronic disease

- Approximately 80% of Australians are living with long-term health conditions, which require a higher level of ongoing healthcare than the general population.

- Increased focus on preventative care

- Federal Government policies aimed at placing greater emphasis on primary and secondary healthcare facilities to reduce the burden of funding on the public system

- This focus is expected to increase demand for these primary and secondary healthcare services.

*Sources: Australian Bureau of Statistics, Australian Institute of Health and Welfare, Health Expenditure Australia 2017-18.

Australian healthcare property sector

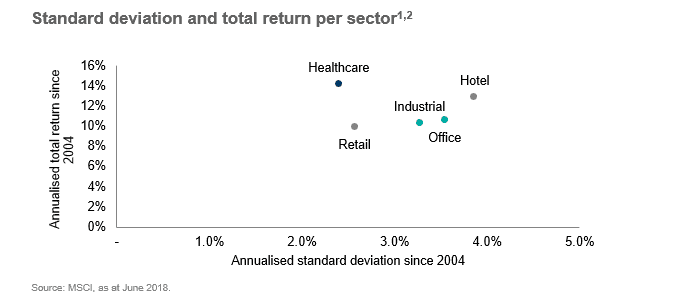

The healthcare property sector has delivered strong returns and experienced relatively low volatility when compared to traditional real estate asset classes.

Characteristics of the healthcare property sector which have driven these trends:

- Stable revenue streams (backed by government funding) allows tenants to commit to longer term leases, creating greater revenue stability

- Non-discretionary nature of healthcare expenditure limits exposure to economic downturns.

Health and aged care property outlook

As a result of Centuria Healthcare understanding the key “forces at work” (anaemic wage growth, increased competition, changes in technology, and surgical behaviours) have led to the emergence of new models of care.

These changes had enabled change in the healthcare property sector which has led to two key changes:

Increased securitisation

Historically, large healthcare real estate property portfolios have been held on balance sheet by major for profit and not-for-profit healthcare operators. It is estimated that $5.2 billion1 of healthcare property is securitised (total Australian securitised property market is $124 billion2).

In terms of the aged care property market, the total Australian securitisable value is $13.8 billion and is forecast to grow to $19.9 billion by 20273. Additionally, opportunities in the aged care property sector are anticipated to increase as a result of the Royal Commission into Aged Care Quality and Safety.

Ongoing sector consolidation

Whilst the healthcare property sector is highly fragmented, a significant consolidation opportunity exists for early movers, where there is mutual benefit in specialised healthcare property fund managers and healthcare operators can achieve scale efficiencies, whilst also enhancing diversification benefits via targeted operator acquisitions.

Opportunities in a shifting market

Centuria Healthcare is optimistic around three key areas:

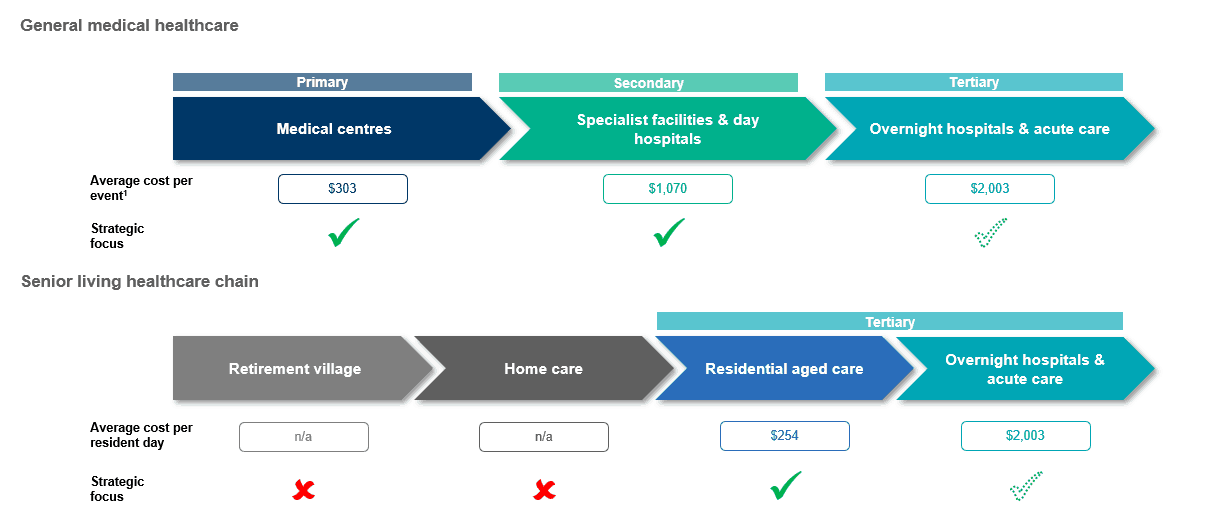

- Surgical or Ambulatory Care: Surgical care can be delivered in a lower cost (and better health outcome) environment through the proliferation of short stay hospitals.

- Aged Care: better (more partnered and mutually beneficial) funding models to drive earnings growth, as well as better models of aged care to drive efficiencies.

- Preventative Care: Ensuring primary care, mixed with the appropriate allied and specialist health care, are driving better health outcomes and more sustainable property investments.

Centuria Healthcare’s point of difference

We know that track record and relationships are highly valued by operators. Centuria Healthcare’s track record and understanding of the sector allows it to become the preferred property partner for operators.

Centuria Healthcare has a differentiated healthcare property portfolio focused on cost effective models of care. This is driven out of Centuria Healthcare’s understanding of the market and identification of opportunities in the healthcare landscape.

What are the different categories of healthcare and what property types fall under each of them?

- The “Healthcare” category is based on the IPD Australia Quarterly Healthcare Index, which provides a broad measure of investment returns for the healthcare property market in Australia and tracks the investment performance of 92 healthcare assets representing $2.6 billion.

- Calculated based on annual total returns on a quarterly basis from December 2004 to June 2018 for the particular property sector as compared to each of the respective asset classes. Emerge Capital (2016).

- Assumes 50% of total industry EBITDA as rent, utilising an 8% capitalisation rate

Interested in hearing about future unlisted property funds?

Please complete the form below to register your interest in receiving updates on future unlisted property fund opportunities.