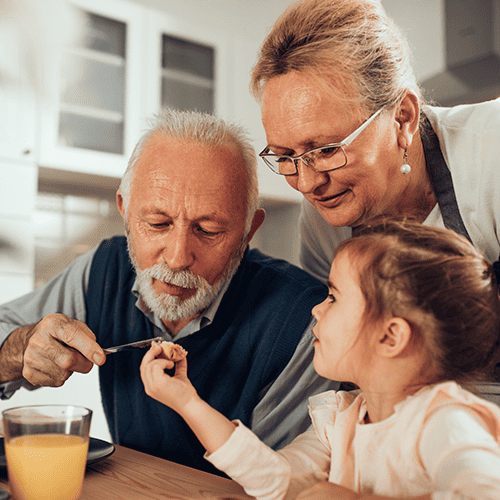

Meet Alana and John Parker. These Sydney based recent retirees are the proud grandparents of Olivia, an energetic and troublemaking six year old who spends her days running around, pretending to be a dinosaur. While she plays without care, Alana and John would like to set aside something for her future.

Alana and John were both self made entrepreneurs and appreciate the support young people need when they reach adolescence. They want to set aside some money for Olivia to benefit from one day, but they want to do so in a tax efficient way that will grow over time.

That’s why they chose Centuria LifeGoals, which as well as being a simple, flexible and tax efficient investment solution, can also be extremely useful for passing wealth onto children and grandchildren.