Latest news

Centuria Industrial REIT opens $116m north Melbourne industrial estate

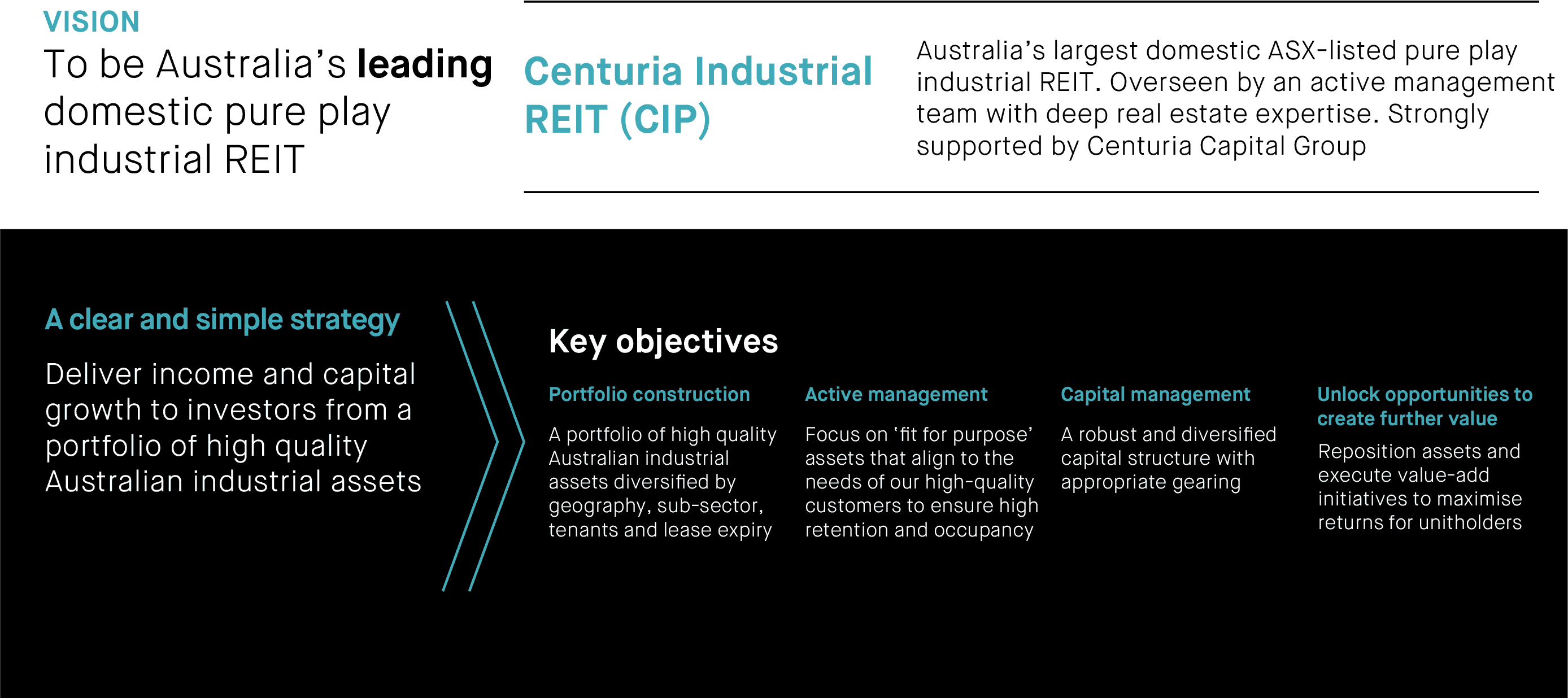

Australia’s largest listed pure-play industrial fund, Centuria Industrial REIT (ASX: CIP), has opened north Melbourne’s newest industrial estate, the $116million “M80 Connect,” with the development already more than 50% leased.

Centuria Industrial REIT sets south Perth industrial benchmark

Australia’s largest listed pure-play industrial fund, Centuria Industrial REIT (ASX: CIP), has secured global alloy and metal specialist, ICD Group, as its first tenant for the recently completed new-build industrial facility at 204 Bannister Road, Canning Vale WA.

CIP announces upgraded earnings guidance and $1bn development pipeline

Centuria Industrial REIT (ASX:CIP) has announced its half year results for the 2024 financial year, which are underscored by upgraded Funds From Operation (FFO) guidance.

Centuria Industrial REIT delivers 30% re-leasing spreads1 in FY23

Centuria Industrial REIT has announced positive year end FY23 results, driven by strong leasing activity – underpinned by an average 30% re-leasing spreads – coupled with a strong balance sheet, low debt gearing and diversified capital structure.

CIP reports 28%1 re-leasing spreads in Q3 FY23

Centuria Industrial REIT (ASX:CIP), has reported year to date positive re-leasing spreads averaged 28%, which reflects continuous tenant demand and record low national vacancy for prime industrial facilities.

Centuria breaks ground in high-demand infill Vic industrial market

Centuria Industrial REIT (ASX: CIP), together with development partner, Cadence Property Group, has broken ground on a new multi-unit industrial facility within Melbourne’s North, the tightly held infill market where current vacancy rates are less than 0.5%.

Occupier demand, rising rents continue to fuel urban infill industrial

Centuria Industrial REIT (ASX: CIP), has reported strong HY23 results underpinned by exceptional re-leasing spreads reflecting continuous industrial occupier demand within urban infill markets across Australia.

CIP cements $181m partnership with Morgan Stanley vehicle

Centuria Industrial REIT (ASX:CIP) has announced an industrial real estate partnership with an investment vehicle sponsored by Morgan Stanley Real Estate Investing