| 22/12/23 | The Fund has exchanged and settled on its fourth high quality asset, the P’Petual glasshouse in Riverlea Park, SA, for $21.50 million. The acquisition features a 10-year triple-net lease with fixed annual rental reviews and following the purchase, the Fund’s portfolio has increased to $351.25 million with a WALE of 16.6 years. The asset, located at 234 Carmelo Road, Riverlea Park SA, provides 12 hectares of protected cropping within a 59 hectare land parcel. This includes six hectares of glasshouses and six hectares of double skinned plastic greenhouses. These facilities have the capacity to produce approximately 1,488 tonnes of tomatoes, 136 tonnes of cucumbers, 517 tonnes of eggplants and 43 tonnes of capsicums per annum. Additionally, the asset includes large packing sheds along with onsite energy, fertigation and reverse osmosis infrastructure as well as a Development Application approval for a four-hectare glasshouse, providing a value-add opportunity to increase operations to deliver even larger volumes of produce. |

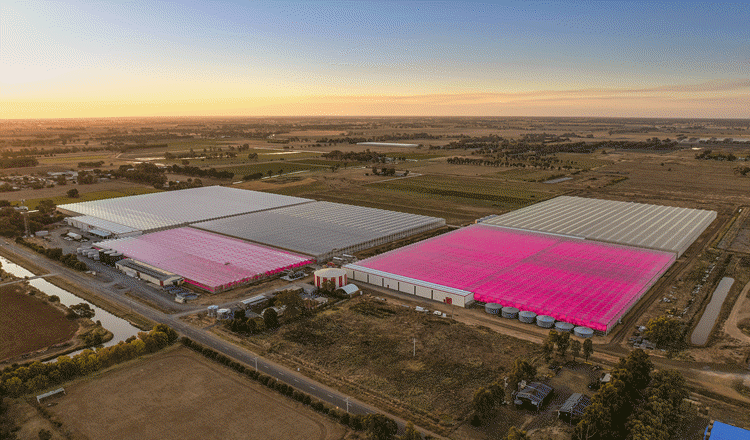

| 23/03/23 | The Fund has exchanged contracts on its third high quality asset, located at 160 Elm St, Guyra NSW, for $76 million and is anticipated to settle on the property on 31 March 2023. The asset includes a 20-hectare tomato glasshouse at the Guyra site. The transaction is the Fund’s third off-market glasshouse acquisition taking the total size of its glasshouses under management to c.74 hectares, worth $323 million with an 18.1-year WALE1, 5.50cpu target distribution rate (annualised)2 and 8% p.a.+ target total return3. Agreement has been reached with the existing tenant, Tomato Exchange Pty Ltd, for a new and extended lease on a 15-year, triple-net lease term with CPI-linked annual rent reviews. Tomato Exchange produces 12,800 tonnes of tomatoes from the asset each year. The tenant is a wholly owned subsidiary of ASX-listed Costa Group, Australia’s largest grower, packer and marketer of vegetable and fresh fruit, which has long-standing relationships with Australian blue-chip fresh produce retailers including Coles, Woolworths, Aldi, Costco and Harris Farms. In addition to the 20-hectare glasshouse, the asset includes a one-acre nursery, 65 megalitre (ML) dam, packing and distribution sheds and cool rooms. The Fund is now open for investment. The Centuria Agriculture Fund is an open-ended unlisted property fund, with daily unit pricing and a limited quarterly liquidity facility, appealing to investors wishing to access high quality agricultural investments, leased to reputable operators on strong lease covenants. Management will continue to provide disclosures on material events, and a quarterly report will be made available to investors in April 2023. - Weighted Average Lease Expiry (WALE) by asset value as at 1 March 2023

- The target distribution rate is the distribution budgeted to be paid for the first month post settlement of the Elm St Glasshouse, which is anticipated to be April 2023, annualised (assuming equal monthly distributions). Actual distributions for subsequent months will be updated on Centuria’s website.

- Target total return only. Centuria will seek to identify properties with income and property attributes that it assesses will contribute to the delivery of the target rates. The target rate is not a forecast, is predictive in nature and is subject to assumptions, risks and circumstances (both known and unknown) that may be outside of the control of Centuria. These assumptions include that the proposed/contracted acquisitions will be acquired by the Fund at current valuations and that funding will be secured at a particular interest rate. The actual returns may differ from the target return. The RE does not guarantee the performance of Fund, the repayment of capital or any income or capital return. Refer to the PDS for assumptions and risks relating to the Fund and its strategy.

|