You are now leaving Centuria Australia

and entering Centuria New Zealand.

Centuria Industrial REIT (ASX: CIP) has acquired its 62nd industrial asset, reaffirming the Trust’s position as Australia’s largest pure-play listed industrial REIT.

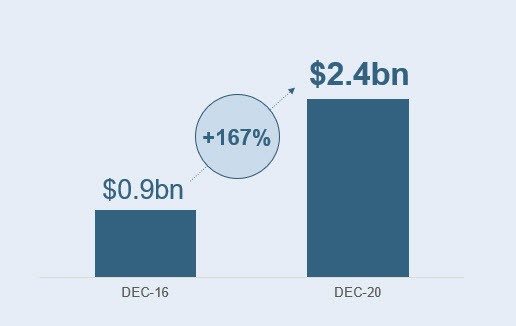

The $2.4 billion REIT’s latest acquisition is a $26.25 million last-mile warehouse in Sydney’s northwest suburb, Bella Vista. The c.8,270 sqm property, located at 8 Lexington Drive, was secured on a short 0.5 year Weighted Average Lease Expiry (WALE), providing a repositioning value-add opportunity.

The Bella Vista transaction takes CIP’s acquisitions throughout FY21 to 12 assets, worth $757.2 million.

CIP has almost tripled its portfolio from $0.9 billion to $2.4 billion across the four-year period between December 2016 and December 2020.

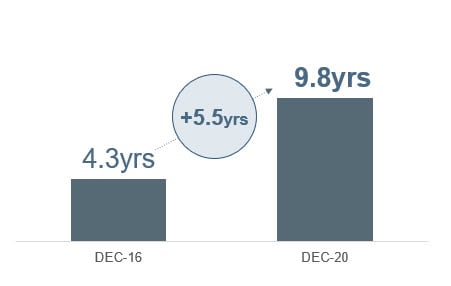

The REIT has also more than doubled its WALE from 4.3 years to 9.8 years during the same period.

Ross Less, Centuria’s Head of Funds Management, comment, “CIP has been Australia’s most active listed fund in terms of the number of industrial assets it’s transacted throughout FY21 to date1. In an increasingly competitive market, we have been successful in securing premium, high-quality properties for our investors such as the $417 million Telstra Data Centre and $214 million worth of cold storage facilities.”

Centuria began managing its industrial REIT from January 2017.

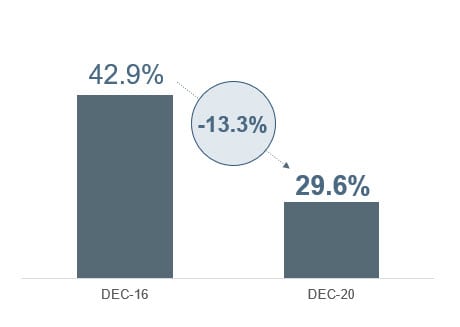

Complementing its expanding portfolio scale and WALE, CIP significantly lowered its gearing from 42.9% in December 2016 to 29.6% as at 31 December 2020.

Its balance sheet headroom has helped the REIT acquire increasingly scarce investment-grade industrial assets.

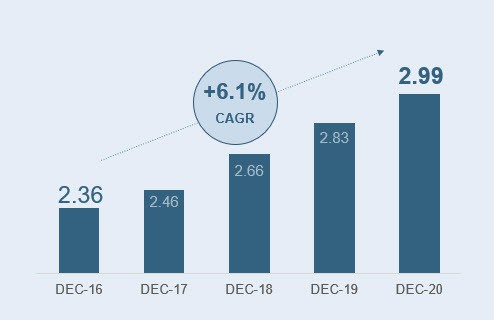

During this period of growth, net tangible assets (NTA) for CIP has grown consistently and continued to deliver investors, together with income from the REIT, a healthy annual return on equity (ROE).

Jesse Curtis, CIP Fund Manager, added, “We are proud of the high-quality assets CIP has been able to secure for its investors. Importantly, these acquisitions contribute to the certainty of cashflow and delivering growing income streams, in fact, during FY21 to date CIP has upgraded guidance twice on the back of high-quality acquisitions.”

“The latest acquisition of the Bella Vista property continues to fill CIP’s value-add pipeline with the opportunity to utilise our active management team to reposition the asset. The property has wide appeal, particularly for last mile users, given its high-profile location and access to a large population catchment.”

CIP’s portfolio has an 90% weighting to eastern seaboard.

The Bella Vista addition is within a tightly held and difficult to buy Sydney market. It provides excellent connectivity to the M2 and M7 motorways, enabling access to 1.2 million households within a 60 minute drive and 358,000 households within a 30 minute drive.

The acquisition will be funded with existing debt.