You are now leaving Centuria Australia

and entering Centuria New Zealand.

Centuria has resumed its quarterly newsletters. In this edition, we highlight the strong interim results for our listed entities, feature one of our new development projects, provide details on recent ESG undertakings as well as highlight recent acquisitions across several asset classes. Our video articles also include text transcripts or subtitles for those who prefer to read our news.

We welcome receiving constructive feedback so feel free to contact us at reception@centuria.com.au.

Despite COVID disruptions, our recent corporate acquisitions – including Primewest, Centuria Bass and our New Zealand team – have been fully integrated into the Centuria fold.

Welcome back to our quarterly newsletters.

This autumn edition provides updates on our interim results for Centuria Capital as well as the CIP and COF listed REITs, news of our latest private hospital development and details about a few new acquisitions.

Most importantly though, I want to highlight that despite COVID disruptions, our recent corporate acquisitions – including Primewest, Centuria Bass and our New Zealand team are fully integrated and performing strongly.

Primewest introduced the large format retail and daily needs retail asset classes as well as agriculture assets to the Group, in addition to two significant international institutional mandates collectively worth more than $1.5 billion.

Centuria NZ has been very active increasing their assets under management by 13% over the six months to 31 December to $2.6 billion and recently embarked on a new $200 million healthcare fund.

Centuria Bass has also exceeded expectations with its loan book increased to $422 million and its open-ended funds rising 17% to $207 million during the first half of the financial period.

Across the board, the Centuria platform and all its divisions have never been stronger and we are confident we can continue this high level of growth.

We look forward to providing more regular updates and investment opportunities in the coming months.

Thank you.

Our platform has expanded to more than $20 billion1, underpinned by a high-quality real estate portfolio that exceeds $19 billion.

This significant expansion is largely credited to organic growth, driven by the:

Two-thirds of our real estate acquisitions were secured for our unlisted funds and a third for our three listed entities. In fact, the value of acquisitions secured during the past six months exceeds what was our entire platform value about five years ago3.

This reflects a tremendous growth trajectory with a 45% compound annual growth rate since June 2017. More significantly, Centuria delivered a 12 month shareholder return of approximately 38%.

This organic growth demonstrates how Centuria has executed on our corporate strategy.

Significant organic growth throughout HY22 was enabled through the consolidation of businesses that have joined the Centuria fold within the past three years, providing us with exposure to the new markets of healthcare, daily needs retail, large format retail, agriculture and unlisted credit funds as well as broader distribution networks and geographical reach.

Centuria now has a truly diversified real estate platform.

During the half, our office portfolio expanded to $7.4 billion, the industrial portfolio to $6 billion, healthcare to $1.7 billion, $3 billion collectively across Daily Needs Retail and Large Format Retail, $600 million in real estate finance and $300 million across agriculture.

In total, our portfolio includes 384 properties housing about 2,500 tenant customers including household names such as Woolworths, Coles, Wesfarmers, Telstra, Arnott’s and Seven West Media.

We also significantly expanded our development pipeline to further support the platform growth by providing our listed and unlisted funds with new, sustainable assets.

Our effective real estate funds management has resulted in a 133% profit increase which is supported by recurring revenues of 87%. This includes a 400% increase in HY22 transaction fee income from $3.5 billion in of total transaction activity.

Centuria continues to manage a healthy balance sheet with $241.1 million of cash and undrawn debt to support growth opportunities and a healthy 9.4 times operating interest cover ratio.

We are very pleased to announce our upgraded FY22 operating earnings per security (OEPS) guidance of 14.5 cents per security (+9.85% above initial FY22 guidance and +20.8% above FY21 OEPS) and we reaffirm our distribution guidance of 11.0 cents per security.

We look forward to updating you on our Full Year 2022 Results later in the year.

1. Includes assets exchanged to be settled, cash and other assets

2. Gross real estate acquisitions and finance activity

3. FUM as at 30 June 2016 was $1.9 billion.

COF’s portfolio expanded to 23 high quality office buildings worth $2.3 billion. Occupancy increased to 94.3% and WALE remained a solid 4.3 years. FY22 FFO Guidance increased to 18.3 cpu and distribution guidance was reaffirmed at 16.6 cpu.

COF performed strongly throughout HY22, allowing us to increase the full year FFO guidance to 18.3 cents per unit. Distribution guidance of 16.6 cents per unit has been maintained, which represents a near 8% distribution yield based on the current trading price.

During the half, COF’s portfolio expanded to 23 high quality office buildings worth $2.3 billion. Occupancy increased to 94.3%1 and the Weighted Average Lease Expiry (WALE) remained a solid 4.3 years.

The portfolio expansion was due to two strategic acquisitions within key Melbourne and Sydney near-city and metropolitan markets worth $273 million. These modern office buildings deliver high occupancy, affordable rents, with strong connectivity to transport hubs and retail amenity.

Increasingly, tenants are gravitating towards new generation buildings that provide better COVID-safe work environments, efficient floorplates, improved amenity and competitively-priced accommodation. COF benefits from a young portfolio, with the average age of its buildings being approximately 16 years, and 90% of its portfolio are A-Grade assets.

COF maintains a robust balance sheet2 with significant debt covenant headroom, a diversified lender pool and substantial undrawn debt. Despite the ongoing impacts from COVID, COF has continued to complete a significant amount leasing activity, with more than 18,600sqm of leases agreed during HY22, representing 6.2% of portfolio NLA.

Leasing success and market fundamentals underpinned a healthy $28.5 million valuation gain3.

With an uptick in white collar employment and Australia’s unemployment rate at its lowest level in 13 years, we already see stronger tenant demand with 185,00sqm of office net absorption across the three months to 31 December 2021 and believe this will continue throughout 2022.

As Australia’s largest listed pure play office REIT, COF remains focused on creating value for its unitholders through a quality portfolio of metropolitan and near city office buildings. COF remains in a strong position to continue delivering a compelling performance into the future.

1. Occupancy increased from 93.1% in June 2021 to 94.3% in December 2021

2. $201 million of equity raised

3. Independent valuations across 11 of 23 assets.

CIP’s portfolio expanded to 80 high quality industrial facilities worth $3.9 billion. Occupancy increased to 99.2% and WALE was maintained at 8.9 years. FY22 FFO Guidance increased to no less than 18.2cpu and distribution guidance of 17.3 cpu was reiterated.

During HY22, CIP delivered strong leasing results with over 109,000sqm of lease terms agreed, representing c.8.5% of portfolio GLA. The strong leasing activity is supported by exceptional occupier demand, particularly from e-commerce users, contributing to CIP achieving an average 10% rental growth over prior passing rents.

Portfolio occupancy increased to a high 99.2% and the Weighted Average Lease Expiry (WALE) was 8.9 years. CIP now has 155 high quality tenant customers, providing a diverse and reliable income stream for investors.

CIP also continued to expand its portfolio to 80 assets worth $3.9 billion, as at 31 December 2021. During the period, the REIT acquired 21 high-quality assets worth $680 million1 including this $200 million super prime distribution centre2, located in the core Sydney industrial market of Fairfield.

Fairfield is THE geographic and population centre of Sydney, with 4.4 million people located within a 60 minute drive. This is a great example of CIP increasing its exposure to urban infill industrial markets that cater to last-mile and e-commerce operators.

Acquisitions made throughout the period were positioned within land constrained, eastern seaboard markets that lend themselves to low vacancy rates and high tenant demand, creating opportunities to extract outsized returns from increasing rental rates. This includes a strategic play to acquire assets adjoining existing CIP-owned sites to create scale and great future optionality in desirable, tightly held industrial markets.

During the period, CIP also benefitted from a significant $280 million valuation uplift (+10% increase on prior book values).

On the financial side, CIP reported a very healthy set of results with a $308.1 million statutory profit and $53.9 million Funds From Operation (FFO), which translates to 9.1 cents per unit, and an 8.7 cents per unit distribution.

Additionally, CIP strengthened its balance sheet by obtaining a Moody’s Credit Rating of Baa2 Stable and successfully completed its inaugural Medium Term Note issuance with a $350 million debt raising.

CIP commenced the second half of FY22 in a strong position having already expanded its portfolio to 84 assets worth $4 billion, providing a 99.2% portfolio occupancy and maintained an 8.9 year WALE.

As Australia’s largest listed domestic pure play industrial REIT and on the back of this strong half of performance CIP provides upgraded FY22 Funds From Operation guidance of no less than 18.2 cents per unit and reiterates its FY22 distribution guidance of 17.3 cents per unit, reflecting a 4.7% distribution yield.

1. Before transaction costs. Includes assets exchanged but not settled as at 31 December 2021.

2. 60,223sqm leased to Fantastic Furniture and DB Schenker Australia, providing a 4.1 year WALE

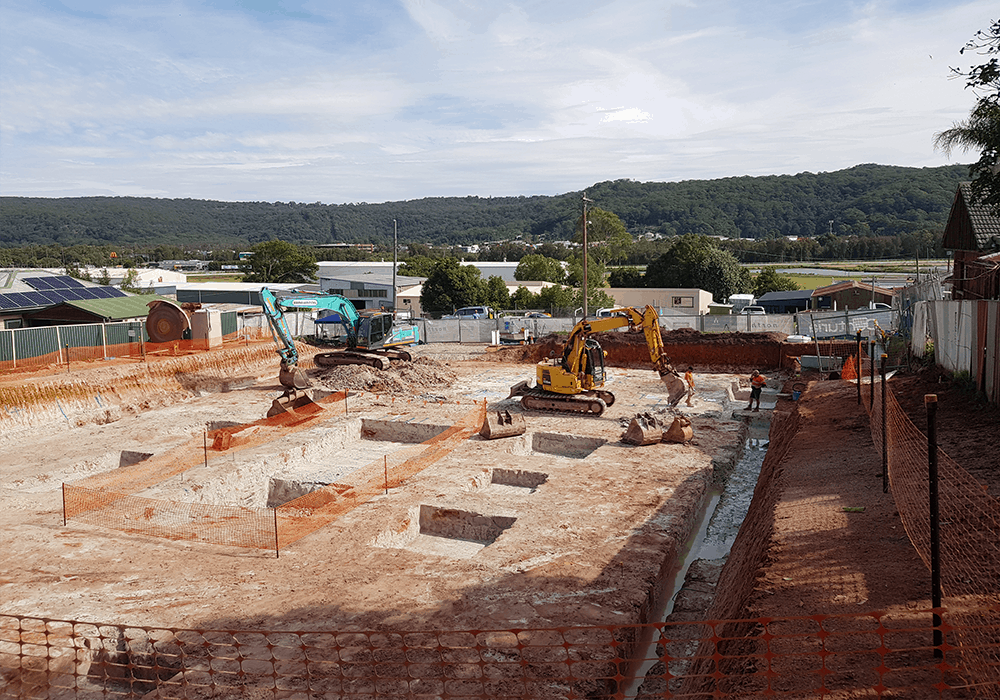

Centuria Healthcare celebrated development starting on its new $60 million private hospital in Townsville Queensland. This is the latest private hospital for the North Queensland community, which will provide a five storey property, complete with four operating theatres, one procedure room, 19 day beds and 22 overnight beds

Part of the development will breathe new life into the heritage-listed building that was once the Townsville West State School. This historic building will be transformed into specialist consulting suites and include a footbridge to the new short-stay hospital.

The entire property is pre-leased on a 25-year term to a newly established operator, Weststate Private Hospital Limited.

Weststate is focused on industry-leading patient care and lowering out of pocket expenses for its patients. It will mainly provide orthopaedics procedures, such as joint replacements. However additional therapies will include treatments across urology, ophthalmology, endoscopy, general surgery, gynaecology, oral, ears-nose-throat, neurosurgery, hepatobiliary, vascular and bariatric.

This will be the first fully digital, greenfield private hospital in the country, and Weststate will use this digital framework to drive quality and efficiency.

Centuria Healthcare has partnered with Geon Property to deliver this exciting new hospital. Geon has been developing projects in the Townsville community for about 25 years. Weststate Private Hospital is close to their hearts as Geon sees the vital, growing demand for healthcare infrastructure within the North Queensland area.

Townsville is growing at a fast pace with its population forecast to jump 38% by 2041i. More specifically, the 65 years and older age group is expected to double during this time, which creates additional demand for healthcare services.

Construction of the Weststate Private Hospital will proceed throughout the coming 16 months and it is anticipated to open by mid-2023.

i According to the 2016 Census which predicts a population increase for the Townsville catchment from 235,037 in 2016 to 324,317 by 2041