You are now leaving Centuria Australia

and entering Centuria New Zealand.

Once pushed into the shadows as superannuation became the tax-effective vehicle of choice, now a new generation of investment bonds are taking centre-stage. Michael Blake, Head of Centuria Life, explains what’s changed.

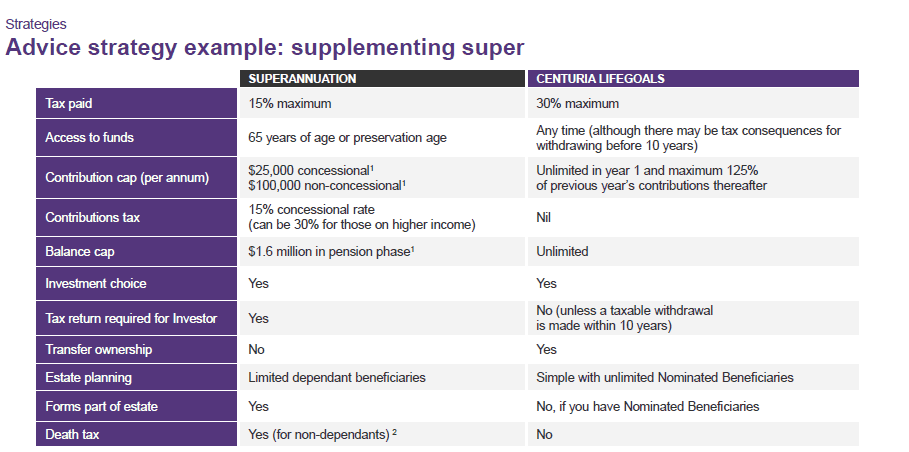

Following changes by successive federal governments, superannuation is no longer as attractive as it previously was, especially if you’re a high-net-worth investor. The restrictions around contribution caps and the balance transfer cap have meant attention has refocused on other tax-effective products, such as investment bonds.

Investment bonds are attractive for a number of reasons but especially for their tax effectiveness and flexibility. Like superannuation, they are tax-paid investments but unlike super, you have access to your funds at any time. The choice of underlying assets has also widened over the years to include access to every asset class, and this makes them an attractive vehicle no matter what stage of life you’re at.

In January this year, we introduced our new and expanded range of 22 high-quality investment bonds, Centuria LifeGoals. Some of their key attractions include the ability to:

Generally, if you hold your Centuria LifeGoals investment for 10 years or more, you pay no additional tax on your investment withdrawals. If you withdraw prior to this, you will normally only pay tax on the difference between 30% and any higher marginal tax rate applicable to you in that financial year on your earnings. In years 9 and 10 this difference is discounted by one-third and two-thirds respectively.

Key advantages of investment bonds such as Centuria LifeGoals include fee transparency, the low minimum investment amount – $500 per option – and that all fund manager rebates and tax benefits are passed through to you as the investor.

Centuria LifeGoals has features that are similar to a managed fund but are combined with a life insurance policy. You can nominate one or more beneficiaries to whom proceeds of the investment are to be paid in the event of the death of the person who is the “Life Insured”. As this payment doesn’t form part of an estate and is instead paid directly to the nominated beneficiaries, it by-passes the often complicated and time-consuming probate process.

1. Superannuation concessional contributions are currently capped at $25,000 for a financial year. The non-concessional contribution cap of $100,000 also applies for each financial year. Superannuation is also subject to a ‘total superannuation balance’ cap (which may limit investors from making additional contributions). Penalty tax rates apply if you exceed either of these caps.

2. If an individual leaves superannuation to non-dependant beneficiaries, they will incur tax on the inheritance.

Like superannuation, the fund pays the tax on your behalf. You do not have to do tax returns on your investment or pay tax on the fund earnings at your marginal tax rate. While the earnings in super funds are taxed at 15 per cent, you can’t access your super until at least age 55. With super there is also a limit on how much you can contribute. Investment bond funds pay a higher rate of tax (30 per cent) however you can access your money whenever you like and contribute what you like in the first year of your initial investment.

Investment bonds have a number of additional advantages over super. Contributions into them aren’t based on your age or employment situation so they provide an alternative if you don’t meet the super work test or if you are aged over 75 and can’t contribute to super.

There are also very low investment limits. For Centuria LifeGoals, the minimum initial amount is $500, while the minimum additional investment is $100. There is also no maximum investment amount on your initial investment. Subsequent contributions however, are limited to 125% of the previous year’s contribution if you wish to receive all growth and earnings on your investment without any personal tax liability after 10 years from the initial start date of your investment.

Like super, investment bonds are generally invested in managed funds. This provides you with a range of options to suit different risk profiles and strategies. With Centuria LifeGoals, there is an attractive range of investments to choose from, which span multiple asset classes and diversified funds. Our investment menu consists of specialist low-cost index funds and high-quality, complementary active investment managers, who are reviewed on an ongoing basis to ensure they are meeting their investment objectives. You can switch between these options at any time free of charge and there are no tax consequences of doing so.

Overall, investment bonds such as Centuria LifeGoals are a fresh and appealing alternative if you’re seeking tax-effective wealth building, peace-of-mind estate planning, access to some of the best fund managers in Australia and an attractive alternative to super wrapped up in one simple tax-effective product.