You are now leaving Centuria Australia

and entering Centuria New Zealand.

By Jason Huljich and Ross Lees

In our roles of Joint CEO and Head of Funds Management, we are frequently asked to comment on potential risks to our listed and unlisted funds. While these vary across asset classes and fund types, inflation and rising interest rates seem to be top of mind lately.

Investors looking at real estate investment may only consider the risks posed by inflation such as rising debt costs, share market investor risks appetite (for A-REITs) and any potential impacts on valuations for property purchases chasing yield. However, investors often overlook positive factors.

1. Positive annual rent reviews

Most leases include fixed annual rental increases or CPI-linked rental increases, which mean rent revenue will increase, which can have a positive impact on investor returns. In theory, the increased rental income offsets other rising costs and, in some instances, can also widen the profitability margin.

2. Limited new stock can aid rental growth

With rising inflation, construction costs are expected to increase, meaning the cost of delivering new buildings is more expensive. This means some development projects will not be feasible, which is likely to tamper the supply coming to the market, which conversely puts pressure on rental values. In short, rents are likely to increase on existing buildings, which will help deliver stronger investor returns.

3. Fringe benefits

It is likely that newly constructed properties will need to offset the increased building costs by also raising rental values. In the Sydney and Melbourne CBDs, these increased rental levels may be challenging at a time when businesses are focused on lowering overheads due to the impact of the pandemic. However, it shines a spotlight on the metropolitan and fringe markets that offer affordable rents. Even when the assets are newly constructed in the non-CBD areas, their rental levels are still comparatively lower, which makes them a compelling proposition for tenants.

We’ve seen this with the acquisition of 101 Moray Street in South Melbourne. The office building was a speculative development, constructed during the pandemic, yet achieved 100% occupation within a few months after build completion. Its gross rental value is 20% less than Prime Melbourne CBD rents, which provides our tenants with more affordable rents while benefitting from new, modern facilities. This illustrates the strength of the fringe office markets.

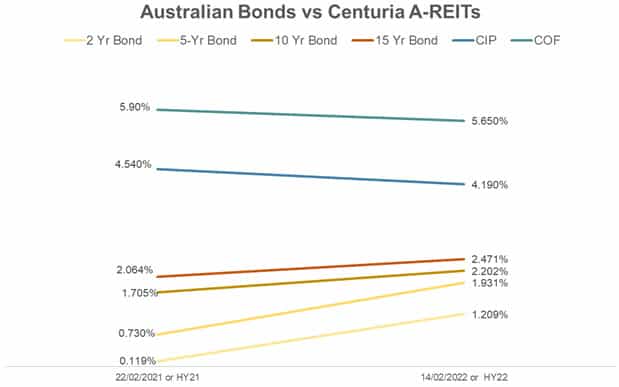

4. Bond spread

A good way to assess the ongoing investment appetite for commercial real estate is to consider the spread between risk free / low risk bond yields. As the risk profiles differ, there is an expectation that there is a spread between A-REIT yields and Australian Bond yields that will generally maintain the appeal of A-REITs.

SOURCE: CIP & COF values taken from HY21 and HY22 Results. Australian Bond Yields between 22 February 2021 and 14 February 2022, sourced from World Government Bonds.

In conclusion, we believe that the concerns regarding interest rate increases and rising inflation may be offset by some silver linings provided by real estate investments.

1. JLL National Office Summary, Q4 2021: prime gross average Melbourne CBD rent of $793/sqm