You are now leaving Centuria Australia

and entering Centuria New Zealand.

Centuria Industrial REIT (CIP), is pleased to announce the successful completion of the fully underwritten institutional placement announced on 27 June 2019, raising $70 million through the issue of approximately 23 million new CIP units at an issue price of $3.05 per new unit.

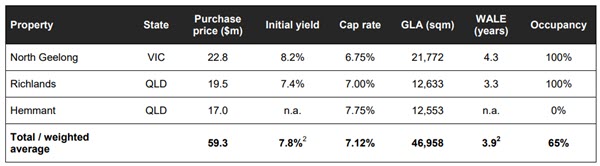

Proceeds of the placement will be used for the acquisition of three high quality industrial assets for a combined value of $59.3 million (excluding costs) with a further $10 million earmarked for capital expenditure to enhance the assets.

Centuria’s Head of Funds Management and CIP Fund Manager, Mr Ross Lees commented: “These acquisitions are consistent with CIP’s strategy to acquire quality assets in key metropolitan locations that we believe are relevant to the broader tenant market.

“North Geelong is fully leased to a subsidiary of Boardriders Inc., a long-term tenant who has invested significant capital expenditure into the facilities. The asset is well located directly opposite the Port of Geelong, and within 10km of Avalon Airport.”

“Richlands is also fully leased with a 3.3 year WALE and located close to another recently acquired property 616 Boundary Road, adding scale within the Richlands industrial area.”

“Hemmant is being acquired on a vacant possession basis, providing an immediate opportunity to reposition the asset, given it is well located within the prime Port of Brisbane precinct.”

Following completion of the transaction CIP’s portfolio will increase to 45 assets with a value of $1.3 billion and continue to be positioned as Australia’s largest domestic pure play industrial REIT.

Settlement of the Acquisitions is expected to occur during June and July 2019.