You are now leaving Centuria Australia

and entering Centuria New Zealand.

Due to the increased demand from investors, Centuria LifeGoals Investment Bonds has launched three new responsible investment options. Responsible investment, or otherwise known as Environmental, Social and Governance (ESG) Investment allows investors to invest in funds that integrate ethical and sustainable themes across the investment process.

The new ESG investment options are;

| Alphinity Sustainable Share Fund |  |

| Walter Scott Global Equity Fund |  |

| Pendal Sustainable Balanced Fund |  |

| Environment | Social | Governance | |||

|---|---|---|---|---|---|

|

Climate Change |  |

Human Rights |  |

Bribery and Corruption |

| Resource Depletion | Modern Slavery | Executive Pay | |||

| Waste | Child Labour | Board Diversity and Structure | |||

| Deforestation | Working Conditions | Political Lobbying and Donations | |||

| Pollution | Employee Relations | Tax strategy | |||

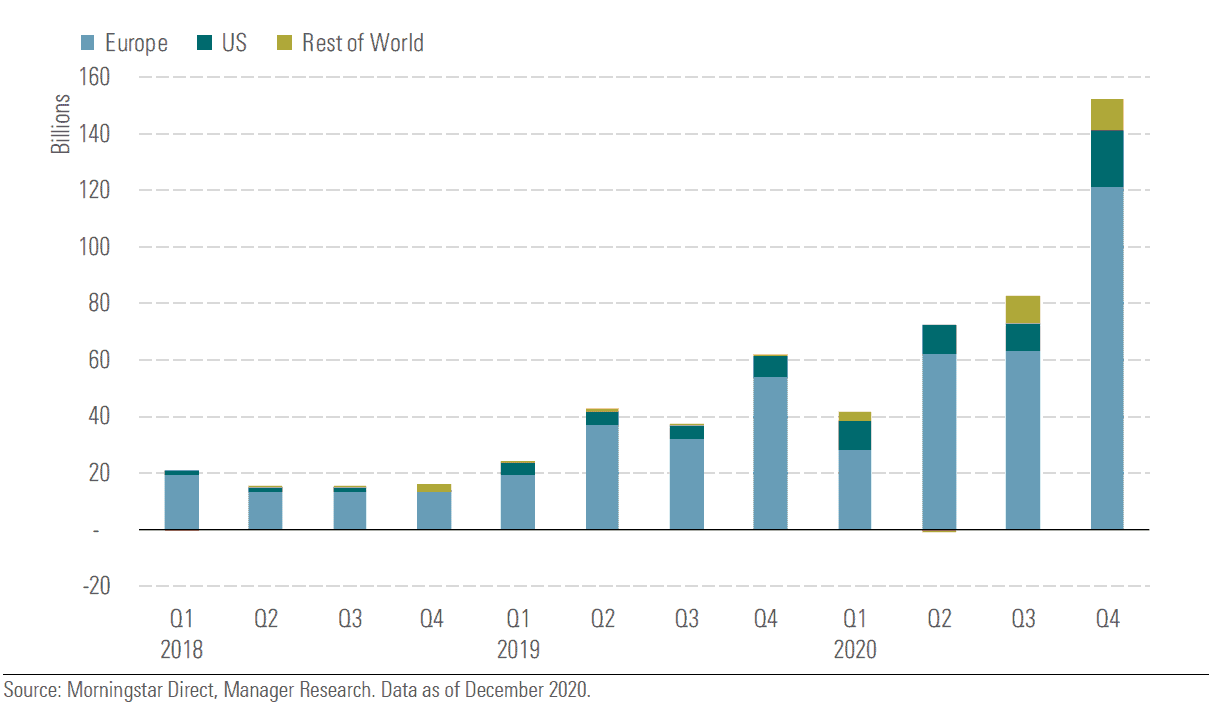

The global sustainable universe attracted USD152.3 billion in net inflows in the fourth quarter of 2020, up 88% from USD82.6 billion in the prior quarter. Europe accounted for the bulk of it (79.3%), while the U.S.A. accounted for close to 13.4% of it. Flows in the rest of the world were considerably higher than in previous quarters, clocking in at USD11.1 billion for Canada, Australia, New Zealand, Japan and Asia combined. This is compared with USD9 billion in the previous quarter.

Figure 1: Quarterly Global Sustainable Fund Flows (USD Billion)

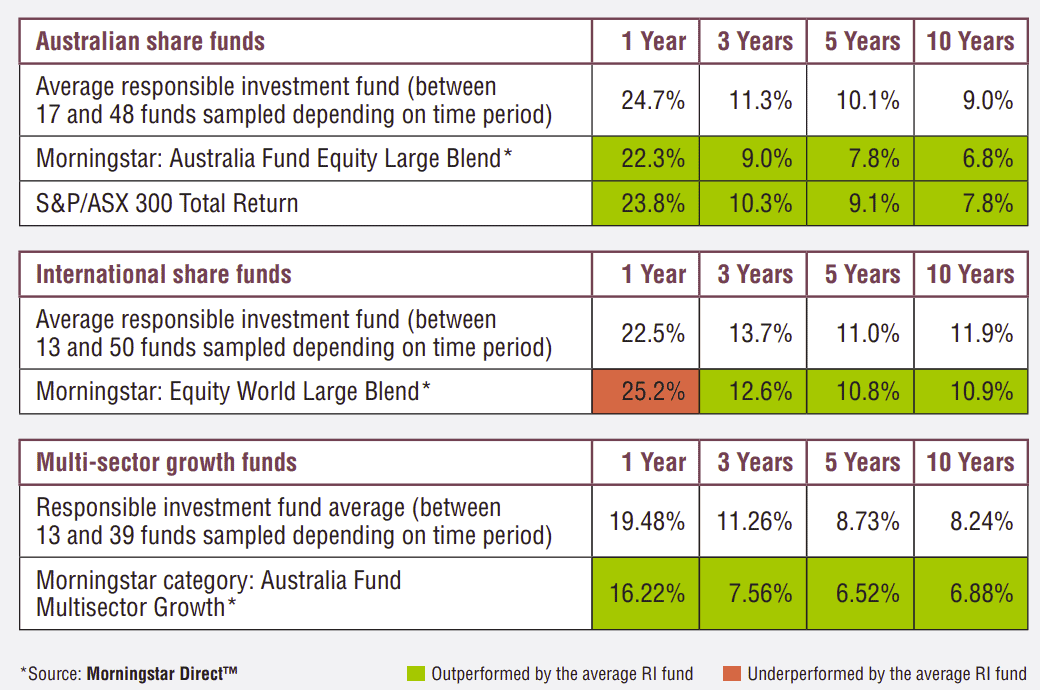

In short, historically no. In the 10 years to 31 December 2019, funds available to Australian investors applying “responsible investment practices” outperformed the main indices across Australian Shares, International Shares and Multi Asset Growth Funds.

Figure 2: Performance of Responsible investment against mainstream funds (weighted average performance net of fees over 10 years)

| Australian share funds | 1 Year | 3 Years | 5 Years | 10 Years |

|---|---|---|---|---|

| Average responsible investment fund (between 17 and 48 funds sampled depending on time period) | 24.7% | 11.3% | 10.1% | 9.0% |

| Morningstar: Australia Fund Equity Large Blend* | 22.3% | 9.0% | 7.8% | 6.8% |

| S&P/ASX 300 Total Return | 23.8% | 10.3% | 9.1% | 7.8% |

| International share funds | 1 Year | 3 Years | 5 Years | 10 Years |

|---|---|---|---|---|

| Average responsible investment fund (between 13 and 50 funds sampled depending on time period) | 22.5% | 13.7% | 11.0% | 11.9% |

| Morningstar: Equity World Large Blend* | 25.2% | 12.6% | 10.8% | 10.9% |

| Multi-sector growth funds | 1 Year | 3 Years | 5 Years | 10 Years |

|---|---|---|---|---|

| Average responsible investment fund (between 13 and 39 funds sampled depending on time period) | 19.48% | 11.26% | 8.73% | 8.24% |

| Morningstar: Australia Fund Multisector Growth* | 16.22% | 7.56% | 6.52% | 6.88% |

| *Source: Morningstar Direct | Outperformed by the average RI fund | Underperformed by the average RI fund |

<!-- -->

-->