You are now leaving Centuria Australia

and entering Centuria New Zealand.

Centuria Capital Group (ASX: CNI) today announced its 2021 Financial Year end results, which revealed the external funds manager doubled (+98%) its assets under management to $17.4 billion1, driven by significant direct real estate transactions as well as expansion via corporate acquisition of New Zealand’s Augusta Capital, Perth-based Primewest and a 50% investment in debt property fund manager, Bass Capital.

Centuria also more than doubled is property platform to $16.5 billion6. Most significantly, its unlisted funds increased 175% to $11 billion and the listed platform grew 37% to $5.5 billion.

The Group collectively acquired7 50 assets worth $2.5 billion, eclipsing the prior period by 108% ($1.2 billion, FY20). Record leasing activity during FY21 totalled 437,000sqm across 215 transactions, which accounted for 17% of the Group’s GLA. The Australasian business now manages 340 assets with 2,280 tenants.

Importantly, Centuria’s development division grew to a $1.9 billion development pipeline2 during FY21, providing its listed and unlisted funds with modern, sustainable A-Grade assets. This includes delivering 41,500 sqm of new real estate worth $127 million during FY21 and the division has a further $1.15 billion in committed projects and $758 million in pipeline projects.

Jason Huljich, Centuria Joint CEO, said, “FY21 was a record year of growth across our listed and unlisted platforms. Decentralised office, industrial and healthcare remain the backbone of our real estate platform, however, we have further diversified our asset classes, expanding into three compelling new sectors – Agriculture, Large Format Retail and Daily Needs Retail, resulting from our merger with Primewest.

“During the financial year, the strength of our in-house transactional capabilities was demonstrated with record acquisitions and leasing, delivering on our development pipeline and active asset management, exemplified with platform rent collection8 of 98.8%.

“It has been a transformational year for our real estate division, both in terms of scale and value created. We remain focused on sourcing quality real estate investment opportunities, utilising our deep real estate expertise and leveraging our platform to create value for our investors.”

During FY21, Centuria launched several unlisted funds throughout Australia and New Zealand, including the:

Additionally, Centuria has a collective $2.3 billion in institutional mandates across four funds, which it have yet to be fully satisfied. These mandates extend to healthcare, office and daily needs retail.

Centuria delivered a 62% 12-month total shareholder return3, outperforming the S&P/ASX 200 A-REIT Index (33.2%). More specifically, it achieved a Compound Average Growth Rate4 (CAGR) of 46% throughout the past five years.

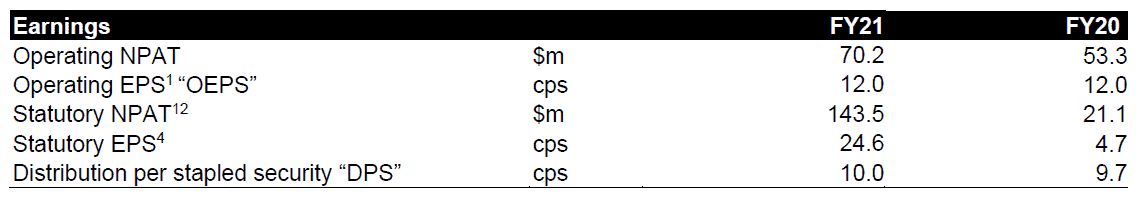

During FY21, the Group’s total revenues rose 40% to $212.7 million and Operating Profit After Tax increased 32% to $70.2 million9. As at 30 June 2021, Centuria has a strong balance sheet with $250 million cash on hand representing an operating gearing ratio10 of 3.9%. Balance sheet flexibility increased from the $198.7 million listed notes issuance. Net asset value11 (NAV) increased to $1.92 (FY20: $1.52).

Operating profit attributable to property funds management was $45.9 million, up 40% on prior corresponding period (pcp) and operating recurring revenue increased to 92% of total revenues (FY20: 86%).

John McBain, Centuria Joint CEO, said “FY21 has been a period of continued, strong performance particularly in view of persisting COVID-19 conditions. Real estate and corporate acquisitions substantially increased AUM, distribution capacity and earnings momentum. These growth initiatives aided Centuria’s increasing market presence, culminating in Centuria Capital’s S&P/ASX 200 Index inclusion.

“In particular, each of the three businesses we merged with throughout FY21 brings its own set of opportunities, which contribute to the Group’s earnings profile, provide access to new sectors as well as distribution channels and markets. Importantly, these mergers provide us with quality, talented staff that are highly experienced in their field. The welcome additions of Primewest, Centuria New Zealand and Centuria Bass Credit add substantial diversity to our geographic footprint, capability and investment opportunities.

“Centuria will continue to grow its platform throughout FY22 and beyond to consolidate its position as a leading Australasian real estate funds manager.”

Throughout FY21, Centuria exceeded its Operating Earnings Per Security5 (EPS) guidance by 9.1%, delivering 12.0 cents per security (cps) while distributions increased 17.6% to 10.0cps.

Centuria has provided FY22 Operating EPS guidance of 13.2cps and distribution guidance of 11.0cps.

1 Centuria AUM as at 30 June 2021. All figures above are in Australian dollars (currency exchange ratio of AU$1.000:NZ$1.0753). Numbers presented may not add up precisely to the totals provided due to rounding. Includes commenced development projects valued on an as if completed basis, cash and other assets, assets exchanged but not settled

2 Development projects and development capex pipeline, including fund throughs

3 Source: Moelis Australia. Based on movement in security price from ASX closing on 1 July 2020 to ASX closing on 30 June 2021 plus distributions per security paid

4 CAGR calculated from 30 June 2017 to 30 June 2021

5 Operating EPS is calculated based on the Operating NPAT of the Group divided by the weighted average number of securities

6 FY20 real estate AUM totalled $8.0 billion

7 Includes transactions post April 2021 Primewest merger announcement, assets exchanged but not settled

8 Excludes Primewest assets, assets exchanged but not settled at 30 June 2021

9 Operating NPAT of the Group comprises of the results of all operating segments and excludes non-operating items such as transaction costs, mark to market movements on property and derivative financial instruments, the results of Benefit Funds, Controlled Property Funds and share of equity accounted net profit in excess of distributions received

10 Gearing ratio is calculated based on (operating borrowings less cash) divided by (operating total assets less cash)

11 Number of securities on issue 30 June 2021: 787,802,693 (at 30 June 2020: 509,998,482)

12 Attributable to securityholders