You are now leaving Centuria Australia

and entering Centuria New Zealand.

Following the release of the three tranches of draft legislation for proposed changes to superannuation, it’s time to take a look at other tax-effective structures and ask how they might stack up for investors.

Treasurer Scott Morrison may not have said outright that he was targeting SMSFs when he announced the proposed changes to super, but he may as well have. The fact is that the potential changes are set to impact SMSF trustees more significantly than the general population, and many are asking what their options to supplement superannuation savings are.

Wealthier Australians are more likely to have an SMSF than less well-off Australians. That’s why the proposed new changes are likely to affect them more. An ASIC commissioned report by Rice Warner found that a balance of $500,000 was the minimum necessary to make an SMSF truly cost effective, unless you are prepared to do some of the fund’s administration yourself. And figures from the Australian Tax Office (ATO) show that the average balance of an SMSF as of July 2015 was more than $1 million for the first time. Given the changes were designed to limit tax concessions for wealthier Australians, SMSF trustees with significant super balances are exactly the group the treasurer has his sights on.

The fact is that many SMSF trustees have chosen this structure in order to have more control over their superannuation as well as to accumulate savings in a tax-effective environment. In many cases, they are saving not only for their own retirement, but also as a way of accumulating wealth to pass on to their children and grandchildren.

But for those who have already reached the $500,000 cap in post-tax contributions proposed in the 2016-17 budget or who are no longer able to contribute as much as they would like to in a tax-effective way, the time may be right to look seriously at alternative tax-effective options. Downsizing SMSF trustees looking to sell the family home and put the proceeds into super, for example, are likely to be unable to do so now, particularly if they live on the eastern seaboard of Australia, where house prices are frequently in the millions.

Two of the most common investment strategies are to create a private company or family trust in which to hold investments or alternatively to establish and contribute to an investment/insurance bond. Both have their pros and cons, but there are some

differences between them which investors need to consider when making their choice.

Using a company structure is a great way to defer paying tax for investors on a tax rate higher than 30 per cent. Funds transferred into the company will be taxed at the corporate tax rate of 30 per cent, as will the earnings from any investments held by the company. This rate is lower than many investors’ marginal tax rate, which can be closer to 50 per cent.

The problem with a company structure is that the corporate tax rate remains applicable only while funds are held in the company structure. As soon as they are transferred out of the company to an individual, that person must pay the difference between the company tax rate and his/her marginal tax rate.

A further downside is that setting up and maintaining a company structure can be very costly. There are numerous regulatory requirements which must be complied with (such as preparing a tax return, following ASIC regulations etc.) all of which incur a cost and often require the services of an accountant.

An investment bond is technically a life insurance product, with a life insured and a nominated beneficiary. In essence however, it operates like a tax-paid managed fund. In the same way that an investor in a managed fund chooses his/her investment portfolio depending on investment objectives and risk profile, investment bond managers also offer a range of portfolio options. Depending on the manager, portfolios range from growth assets like domestic and international equities to more defensive assets like fixed income and case or a mix of assets.

An investment bond is considered tax paid, because all returns from the bond’s investment portfolio remain within the bond structure and are taxed at the corporate rate of 30 per cent. Earnings are reinvested in the bond, investors do not receive any income, and therefore do not need to declare the bond to the tax office or pay any income tax.

There is no limit to the amount that an investor can contribute to an investment bond and additional contributions can be made each year to the value of 125 per cent of the previous year’s contribution.

The great benefit of an investment bond is that at the end of 10 years, all proceeds from the bond (including the initial investment) are distributed to the investor tax paid. They do not need to be included in the investor’s tax return and can be distributed as a lump sum or in regular payments over a specified time period.

At the same time, and in contrast to superannuation, it is possible to access the funds in the bond before the 10-year period is up. If this happens, the investor will simply pay the difference between the 30 per cent company tax rate and his/her marginal tax rate. Unlike a company structure, an investment bond is an effective wealth transfer tool. When the bond is created, a beneficiary can be nominated and this person will receive the proceeds of the bond tax-free on death of the life insured. This is the case if the life insured passes away before 10 years.

Ultimately, every investor’s situation is different and for the vast majority of Australians, as for many SMSF trustees, super will remain the most tax-effective savings option available. However, for those who will be affected by the proposed changes, taking a closer look at other tax-effective options, like investment bonds may be worth considering.

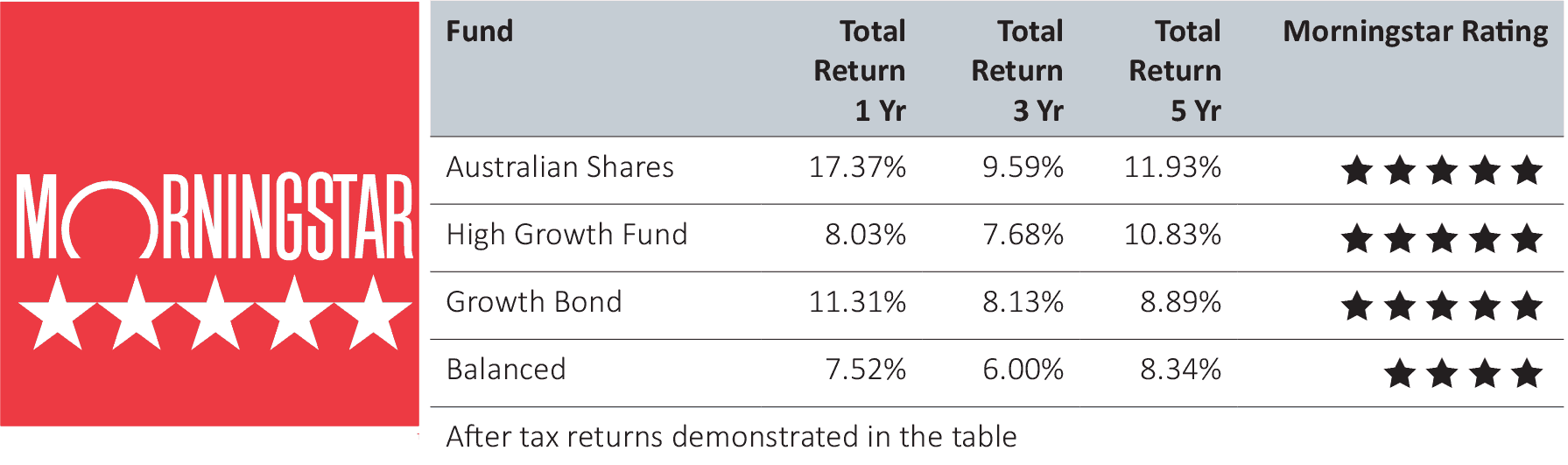

Performance figures are correct to 30 September 2016

| Bond | Net Performance* | |||

| 1 year | 2 years | 3 years | 5 years | |

| Centuria Growth Bond Fund | 11.31% | 8.79% | 8.13% | 8.88% |

| Centuria Balanced Fund | 7.52% | 6.19% | 6.00% | 8.34% |

| Centuria High Growth Fund | 8.04% | 8.04% | 7.68% | 10.83% |

| Centuria Australian Shares Fund | 17.37% | 10.78% | 9.59% | 11.93% |

| Centuria Implemented Portfolios Dynamic Asset Allocation Bond | 4.67% | |||

| Centuria Cash Plus Fund | 2.84% | |||

For more information about Centuria’s Investment Bonds please call 1300 50 50 50 or email enquiries@centuria.com.au.

We look forward to supporting you and your business.