You are now leaving Centuria Australia

and entering Centuria New Zealand.

Centuria Industrial REIT (ASX:CIP), today announced that it will be included in the Financial Times Stock Exchange (FTSE) European Public Real Estate (EPRA) National Association of Real Estate Investment Trusts (Nareit) Global Index from Monday 21 June 2021.

The FTSE EPRA Nareit is a global index that tracks listed real estate investment trusts’ performance throughout the world based on funds’ liquidity, size and revenue.

Jesse Curtis, CIP Fund Manager, said, “Inclusion in this global index is a significant milestone for CIP and indicative of how the REIT has matured in terms of its scale, performance, value and the high-quality of its industrial assets. We have a dedicated and loyal investor base, and we anticipate this index inclusion will offer domestic and overseas unitholders with efficient means to compare CIP with international peers.”

Centuria began managing the REIT in 2017 and has since grown CIP’s portfolio to 61 high-quality assets worth $2.9billion with a 9.7-year weighted average lease expiry (WALE) and 98.8% occupancy1. CIP is also included in the S&P/ASX-200 Index.

CIP is Australia’s largest domestic pure-play industrial REIT listed on the ASX.

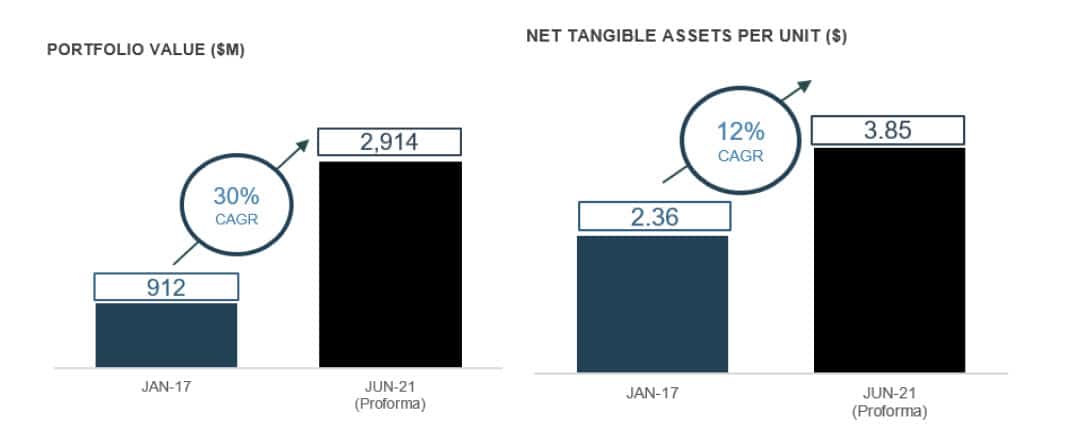

Since January 2017 CIP’s Market Capitalisation has grown from $534million to $2.0billion as at 31 May 2021. During the same period, its portfolio value increased from $912million to $2.9billion, Net Tangible Assets (NTA) per unit increased from $2.36 to $3.85 and Total Shareholder Return (TSR) is 94%, significantly outpacing the ASX 200 AREIT TSR of 28%2.

Mr Curtis continued, “When we began managing the REIT in 2017, we identified the structural shift from shops to sheds and particularly focused on last-mile, infill assets that are well positioned near transport arterials. These types of assets have attracted high-quality, blue-chip tenants on predominately long-term leases, providing a sustainable and resilient portfolio.”

Ross Lees, Head of Funds Management, add continued, “For the past five years, Centuria has increased its exposure to the industrial sector, not just within CIP but across the entire Centuria Capital Group (ASX: CNI) platform. This includes Centuria’s listed and unlisted funds across Australian and New Zealand, totalling more than $4billion3 worth of industrial assets under management.”

Since FY20 Year End, the REIT’s total portfolio Weighted Average Capitalisation Rate (WACR) firmed 152bps, from 6.05% to 4.53%. Pro forma Net Tangible Assets (NTA) has increased by 36.5% from $2.82 to $3.85 per unit throughout the same period.