You are now leaving Centuria Australia

and entering Centuria New Zealand.

- Centuria Capital (CNI)

- Centuria Office REIT (COF)

- Centuria Industrial REIT (CIP)

- Centuria Capital No.2 Fund (C2FHA)

Centuria Diversified Property Fund

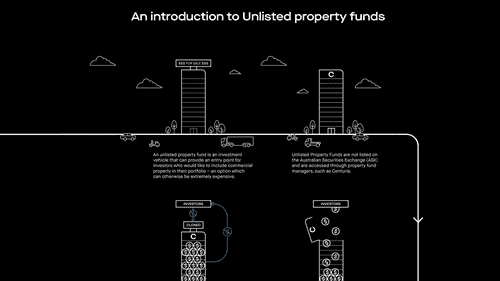

The Centuria Diversified Property Fund (CDPF) is an open-ended unlisted property fund that aims to provide investors with stable income returns and the potential for capital growth by investing directly and indirectly in a diversified property portfolio.

Centuria Diversified Property Fund is open to applications. You can invest in this property investment fund with as little as $10,000. There is no minimum or maximum term of investment1.

ARSN CDPF 611 510 699 ARSN PPIF 645 597 404 APIR CNT9370AU

Fund overview

Fund objective

The Centuria Diversified Property Fund (CDPF) is an open-ended unlisted property fund that aims to provide investors with stable income returns and the potential for capital growth by investing directly and indirectly in a diversified property portfolio.

| Asset Class | Target Asset Allocation (%) |

|---|---|

| Direct property and unlisted property funds | 90-100 |

| A-REITs, cash or cash-like products | 0-10 |

| TOTAL | 100 |

Fund stapling

The Centuria Diversified Property Fund is a stapled fund comprising the Centuria Diversified Property Fund (ARSN 611 510 699) (CDPF) and the Centuria Diversified Property Fund No.2 (ARSN 645 597 404) (CDPF No.2) (formerly known as the Primewest Property Income Fund). For more information about the stapling of the fund please click here.

SIV compliant fund

Implementation of the Significant Investor Visa (SIV) on 24 November 2012 by the Australian Federal Government is a great opportunity for people looking to migrate to Australia.

This legislation allows high net worth investors who invest at least $5 million Australian dollars into investments that meet the SIV guidelines to apply for permanent residence through the Business Innovation and Investment (Permanent) visa (subclass 888) Significant Investor stream if certain requirements are met.

The Centuria Diversified Property Fund complies with the SIV guidelines. Find more information about SIV compliance.

Why Centuria?

Centuria Capital Group (Centuria; ASX:CNI) is an Australian Securities Exchange-listed specialist fund manager. Centuria Property Funds Limited (ABN 11 086 553 639, AFSL 231149), a wholly-owned subsidiary of Centuria, is the Responsible Entity of the Centuria Diversified Property Fund (CDPF) (ARSN 611 510 699).

Centuria offers investments in listed and unlisted property across 400+ high quality office, industrial, large format retail, daily needs retail, rural and healthcare assets around Australia. We are a relationship business, forging close connections with investors and actively managing properties to improve usability and attract and retain good tenants. We see this as our competitive advantage.

Centuria’s Value Add Investment Philosophy

Centuria’s investment philosophy is founded on an active management approach to real estate where relationships are key and there is the potential for value to be added at all stages of the investment process (acquisition, ownership, management and disposal).

Centuria believes it has a particular strength in identifying assets that require intensive asset management to maximise returns and has an in-house team to deliver the requisite range of value-add services. Centuria does not try to predict broader macro economic trends but instead believes that an asset that is well acquired and actively managed will outperform a passive approach through the full economic cycle.

Centuria’s Investment Process

Centuria believes in a “hands-on” approach to managing property assets. Unlike a lot of property fund managers, Centuria does not outsource its office and industrial property management to real estate agents (although property management may be outsourced in remote locations or for special purpose assets).

Centuria has a fundamental belief that it can deliver better returns from its property assets by having a closer relationship with the tenants and a better understanding of the buildings themselves.

Portfolio snapshot

As at 31 December 2023

Property assets

The Centuria Diversified Property Fund (CDPF) invests in direct property, Centuria unlisted property funds, A-REITs, cash or cash-like products. Read more about the current investment portfolio.

Performance, pricing and distributions

Fund performance8,9 (as at –)

–

Fund unit price (as at –)

Fund distributions (previous 6 months)

–

Request a PDS

Express your interest in the Centuria Diversified Property Fund to receive a Product Disclosure Statement (PDS).

How to invest

As an investor, you can invest directly with us (refer to PDS) or via an investment platform if you have a financial adviser. The Fund is currently available on the following investment platforms:

- Netwealth

- Hub24

- Macquarie Wrap

- Colonial First State Wrap

- IOOF Pursuit

- OneVue – Fund.eXchange

- FNZ

- Wealth O2

- Bendigo and Adelaide Staff Super

- Medical and Associated Professions Super Fund

- AustChoice

- Powerwrap

- AMP North

* CPU = Cents per unit. Distribution figures are monthly and are not annualised.

~ Inception date of CDPF, prior to merger, is 24 June 2016. The implementation of the stapling of CDPF and CDPF No.2 occurred on 27 May 2022.

1. Distributions will be paid if declared by Centuria Property Funds Limited and Primewest Management Ltd and will be subject to the terms set out in the PDS.

2. As at –

3. Withdrawals are limited to the terms detailed in the Fund’s PDS and are subject to CDPF’s liquidity policy. The ability of the Fund to offer quarterly withdrawals is not guaranteed.

4. The Core Property rating (assigned in April 2021) presented in this document has been prepared and issued by Core Property Research Pty Ltd (“Core Property”), which is an Authorised Representative ASIC number 1280479 of Core Property Research Holdings Pty Ltd (ACN 633 170 751, AFS License No. 518320) (Licensee), and trading as Core Property. Whilst the information contained in the report has been prepared with all reasonable care from sources that Core Property believes are reliable, no responsibility or liability is accepted by Core Property for any errors, omissions or misstatements however caused. Past performance information is for illustrative purposes only and is not indicative of future performance. The Core Property publication is not and should not be construed as, an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Any opinion contained in the Report is unsolicited general information only. Neither Core Property nor the Participant is aware that any recipient intends to rely on this Report or of the manner in which a recipient intends to use it. To access the full report, please visit www.coreprop.com.au. The rating is subject to change without notice and Core Property assumes no obligation to update the report.

5. Lonsec ratings disclaimer: The Lonsec Rating (Centuria Diversified Property Fund assigned April 2021) presented in this document is published by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445. The Rating is limited to “General Advice” (as defined in the Corporations Act 2001 (Cth)) and based solely on consideration of the investment merits of the financial product(s). Past performance information is for illustrative purposes only and is not indicative of future performance. It is not a recommendation to purchase, sell or hold Centuria product(s), and you should seek independent financial advice before investing in this product(s). The Rating is subject to change without notice and Lonsec assumes no obligation to update the relevant document(s) following publication. Lonsec receives a fee from the Fund Manager for researching the product(s) using comprehensive and objective criteria. For further information regarding Lonsec’s Ratings methodology, please refer to our website at: http://www.lonsecresearch.com.au/research-solutions/our-ratings.

6. Weighted by gross income.

7. The NABERS rating is for Energy and applies to the Fund’s office assets only. The Fund’s industrial and social infrastructure assets are not subject to rating.

8. Performance is shown for informational purposes only. Past performance is not a reliable indicator of future performance. Performance fees may affect total return performance. Annualised total return figures are the sum of the annualised income return and the annualised capital return (each calculated on a standalone basis). Returns of less than 1 year are not annualised.

9. The implementation of the Stapled Fund occurred on 27 May 2022. The performance shown here illustrates the performance of CDPF (standalone) prior to implementation, and the performance of the Stapled Fund (CDPF and CDPF No.2 consolidated) following implementation.

CA-CPFL-12/11/18-00869