Centuria Industrial REIT delivers 30% re-leasing spreads1 in FY23

Industrial real estate tailwinds supported by strong tenant demand

- 182,004sqm leased achieving2 37% re-leasing spreads in 2HY23, up from 19% in 1HY23

- 40,544sqm of infill industrial development completions; c.57,300sqm under construction

- Strong balance sheet: $215m of divestments at av. 2% premium, reduced gearing, diversified capital structure

- Delivered on FY23 Guidance with FFO3 of $108.1m (17.0cpu) and Distributions of 16.0cpu

- 16.4% 12 month Total Shareholder Return (TSR), double S&P/ASX-200 A-REIT Index benchmark4

- Portfolio: 98.0% portfolio occupancy5, 7.7 year WALE, 89 assets worth $3.8 billion6

Centuria Industrial REIT (ASX:CIP), Australia’s largest listed pure-play industrial REIT, today announced positive year end FY23 results, driven by strong leasing activity – underpinned by an average 30%1 re-leasing spreads – coupled with a strong balance sheet, low debt gearing and diversified capital structure.

During the period, CIP leased 182,004sqm2 across 30 transactions, representing 14% of its portfolio GLA. The REIT’s portfolio has an 83% weighting to urban infill industrial markets where tenant demand is concentrated, and vacancy is lowest. CIP’s focus on these markets facilitated re-leasing spreads of 37% during the second half of the year, up from 19% for the half to December 2022. This is a significant increase from the FY22 re-leasing spreads of 11%.

Currently, c.36% of CIP’s leases expire during the next three years, providing further opportunities to capture rental growth in the future.

The REIT maintains strong portfolio metrics with a high 98.0% occupancy5 and 7.7 year WALE across 89 assets worth $3.8 billion6.

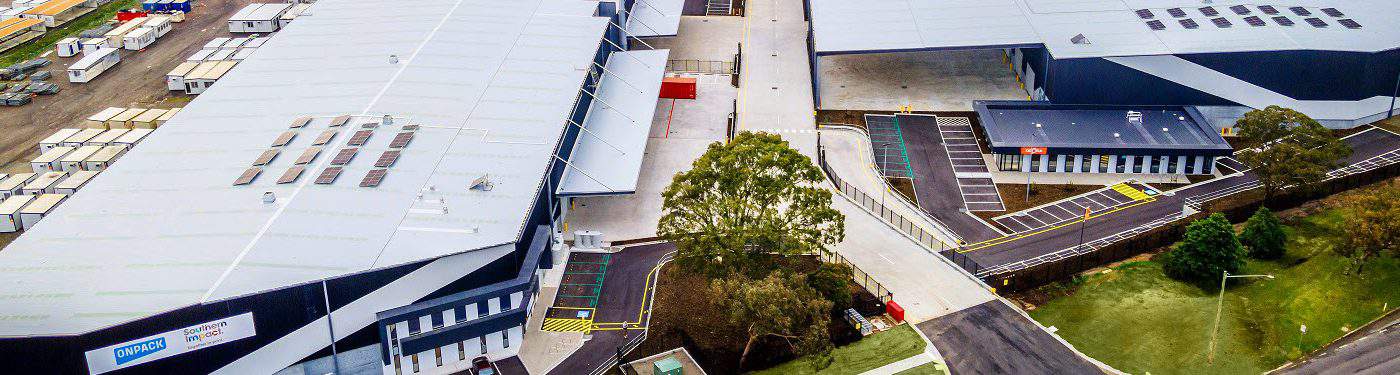

To harness high occupier demand and limited vacancy, during the period CIP delivered 40,544sqm of new infill industrial space and is bringing a further c.57,300sqm to market across Vic and WA.

Jesse Curtis, CIP Fund Manager and Centuria Head of Industrial, said, “Throughout FY23, CIP continued to capitalise on strong leasing momentum and accelerated re-leasing spreads. Having a portfolio heavily weighted to urban infill markets on Australia’s east coast, CIP demonstrated outsized re-leasing spreads. The high leasing volume achieved is owed to CIP’s strong tenant customer relationships and value add project track record. In particular, CIP successfully, fully leased the recently completed Southside Industrial Estate and is progressing two further developments within Campbellfield Vic and Canning Vale WA.”

During FY23, CIP’s balance sheet remained strong with proactive capital management. CIP issued a $300 million exchangeable note diversifying its capital sources and executed strategic divestments totalling $215 million to maintain low gearing at 33.1%7. The divestments were transacted at an average 2% premium to prior book values.

Among the divestments was the c.50% sale of eight assets for $180.9 million, resulting in the Centuria Prime Logistics Partnership (CPLP), and the $34.5 million divestment of 30 Clay Place, Eastern Creek NSW.

Mr Curtis continued, “Pleasingly, portfolio leasing and value add projects, together with balance sheet initiatives, resulted in CIP delivering guidance. Twelve month shareholder return was 16.4%, which was double the S&P/ASX 200 A-REIT index performance (8.1%)4.”

CIP’s portfolio Weighted Average Capitalisation Rate (WACR) expanded 107bps in FY23 to 5.26%, with leasing success and market rental growth substantially offsetting the capitalisation rate expansion.

Jesse Curtis concluded, “Looking ahead, Australia still holds one of the lowest industrial vacancy rates globally. Tenant demand remains resilient and, with constrained supply of new industrial space, rental growth is expected to be prolonged. Within this environment, CIP is well placed to execute its strategy with a high quality portfolio of industrial assets and a strong value add pipeline of leasing, repositioning and development projects.”

CIP provides FY24 FFO guidance of 17.0cpu and distribution guidance of 16.0cpu, representing a 5.1%8 distribution yield, paid in equal quarterly instalments.

1. On a net rent basis compared to prior passing rents

2. Includes heads of agreement (HOA)

3. Funds from Operation (FFO) is CIP’s underlying and recurring earnings from its operations. This is calculated as the statutory net profit adjusted for certain non-cash and other items

4. Source: MA Financial Group

5. By income

6. At CIP ownership share of joint venture assets

7. Gearing is defined as total interest bearing liabilities divided by total assets

8. Annualised yield based on CIP unit closing price of $3.15 on 10 August 2023

Related articles

Centuria Industrial REIT opens $116m north Melbourne industrial estate

Australia’s largest listed pure-play industrial fund, Centuria Industrial REIT (ASX: CIP), has opened north Melbourne’s newest industrial estate, the $116million “M80 Connect,” with the development already more than 50% leased.

Centuria Industrial REIT sets south Perth industrial benchmark

Australia’s largest listed pure-play industrial fund, Centuria Industrial REIT (ASX: CIP), has secured global alloy and metal specialist, ICD Group, as its first tenant for the recently completed new-build industrial facility at 204 Bannister Road, Canning Vale WA.