A leading Australasian ASX 200 funds manager

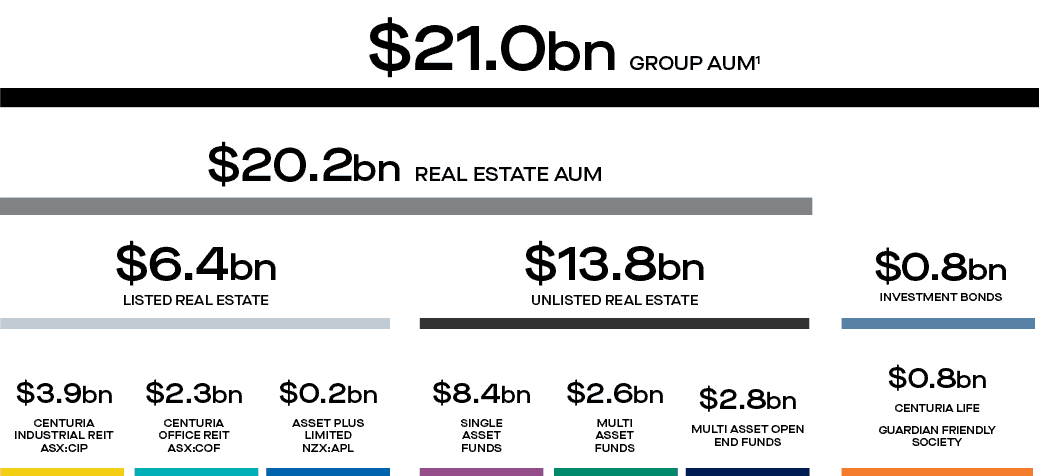

Throughout FY23, Centuria Capital Group (ASX:CNI) grew its funds management platform to $21 billion1 of AUM and continued to focus on differentiating its traditional office, industrial and retail platforms, while markedly expanding across the alternative sectors of real estate finance, healthcare and agriculture.

Centuria met its operating earnings per security (OEPS) guidance of 14.5cps2 and distribution per security (DPS) guidance of 11.6cps (+5.5% above FY22 DPS).

The Group maintains a healthy balance sheet with the capacity to fund organic growth.