You are now leaving Centuria Australia

and entering Centuria New Zealand.

Centuria hosts JLL’s latest office markets findings

Centuria Capital was proud to host JLL’s Head of Research (Australia), Andrew Ballantyne, who delivered the latest findings on the future of the Australian office markets.

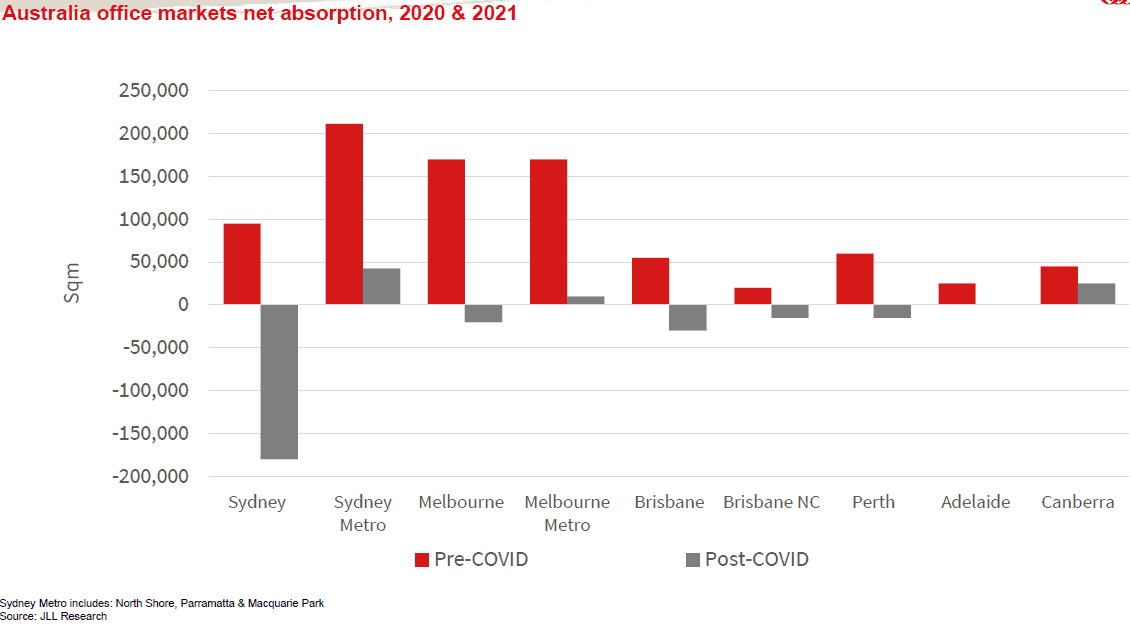

More than 150 attendees registered for the JLL/ Centuria’s Australian office markets webinar last Thursday, which highlighted differing results and trends among CBD and Metropolitan office markets – particularly in terms of net absorption rates. Equally, the impact of COVID-19 revealed cities throughout Australia have had varying impacts.

Grant Nichols, Centurial Office REIT (ASX:COF), who is responsible for the c.$2.1 billion office portfolio1, commented, “Andrew’s research presented a thematic Centuria has long believed anecdotally and which will be accelerated by current circumstances – that tenant preferences are moving toward a ‘hub and spoke’ model.

“Put simply, workers want to be in offices located in short proximity of their homes, avoiding long commutes and preferably with easy access to public transport nodes. Tenants are paying closer attention to worker satisfaction, particularly in light of COVID-19, and location plays a key role.”

JLL’s net absorption rates for 2020 indicate a positive take-up in Sydney Metro, Melbourne Metro and Canberra, despite the impact of COVID-19, which is far better than negative absorption recorded in a number CBD markets.

Other key findings revealed an expectation the labour market will recover quicker than previous recessions.

Additionally, offices are increasing considered more than just a place to work; they must lend themselves to workers’ lifestyles and current circumstances. For this reason, tenants are paying closer attention to offices that offer additional amenity and allow for greater levels of clean technologies and social distancing, something that is more commonly found in newer buildings.

As a whole, the investment demand outlook for quality, well tenanted office buildings remains strong with the current spread between Australian Government 10-year bonds office sector discount rates typically being viewed as wider than other historical benchmarks.

1. As at 31 December 2020

You can watch the presentation by registering.